2023 QMCA CSQ Queensland Major Projects Pipeline Report

The Queensland Major Contractors Association (QMCA), in conjunction with Construction Skills Queensland (CSQ) and key authors (Oxford Economics, Arcadis and Aurora Marketing) is proud to present the 12th edition of the QMCA CSQ Queensland Major Projects Pipeline Report (QMPPR). The 2023 version of this report and pipeline highlights the significant rise in engineering construction activity in Queensland and identifies that the work ahead of the industry is robust and solid, despite the current headwinds of rising costs, challenging labour markets, declining productivity and the Federal Government’s current ongoing and slow review of infrastructure investment.

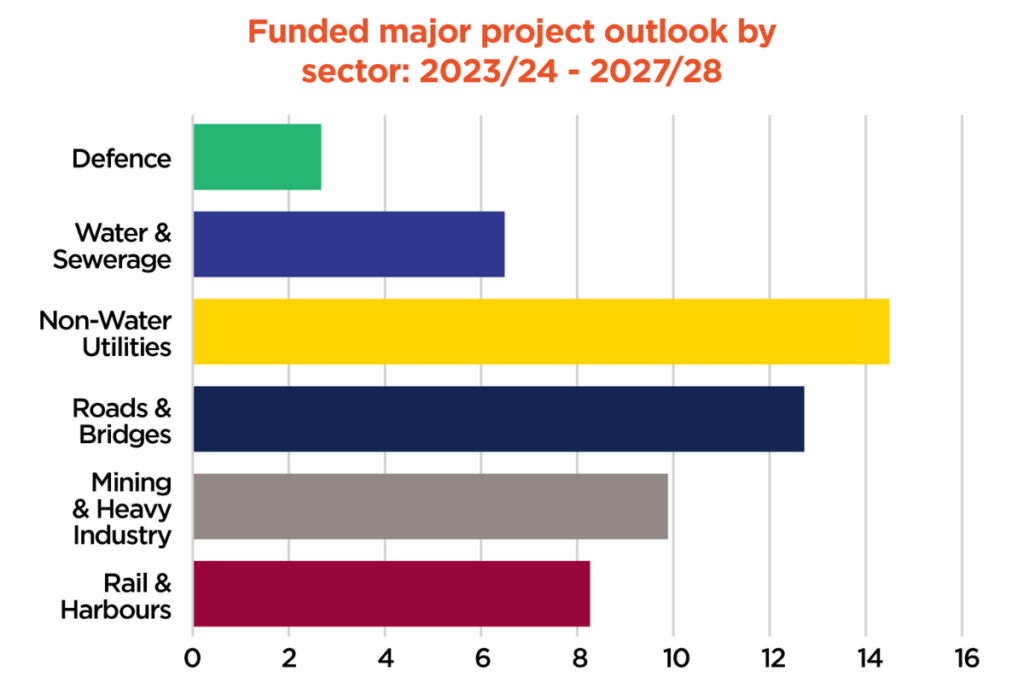

For over a decade, the QMPPR has delivered a comprehensive list of major engineering construction projects combined with an analysis on the corresponding level of construction activity. The coverage of the 2023 QMPPR are projects expected to be in the construction phase over the next five years to 2027/28. Major project activity in Queensland is expected to rise strongly in the coming years, with double digit annual growth rates over the first four years of the pipeline. The current five year pipeline has risen to $92b, a $20.6b (29%) increase from 2022. Funded activity accounts for a large portion of this upgrade and has risen in each of the forward years compared to the 2022 report, with total funded activity in the 2023 QMPPR growing by $16.7b to $54.4b. Much of the increase in funded work is due to a selection of utilities and mining and heavy industry projects concentrated in the western and south-east regions of the state.

- DOWNLOAD THE REPORT EXECUTIVE SUMMARY

- DOWNLOAD THE FULL QUEENSLAND MAJOR PROJECTS PIPELINE REPORT

- DOWNLOAD THE REPORT DATA SETS

- DOWNLOAD THE QMCA BRISBANE EVENT SLIDE DECK

The 2023 QMCA CSQ Queensland Major Projects Pipeline Report is proudly supported by:

Platinum Partners – CSQ – Construction Skills Queensland

Gold Partners – Clough and Western Downs Civil

Regional Partners Brisbane – Bennett + Bennett and John Holland

Regional Partners Toowoomba – Bennett + Bennett and Stanwell Corporation Limited

Regional Partners Townsville – BMD Group and Sunwater

Regional Partners Gladstone – Coffey Testing and Stanwell Corporation Limited

Report Partners – Degnan and stratagility

Event Partners – Toowoomba and Surat Basin Enterprise, Townsville Enterprise (TEL) and Gladstone Engineering Alliance

Total Pipeline

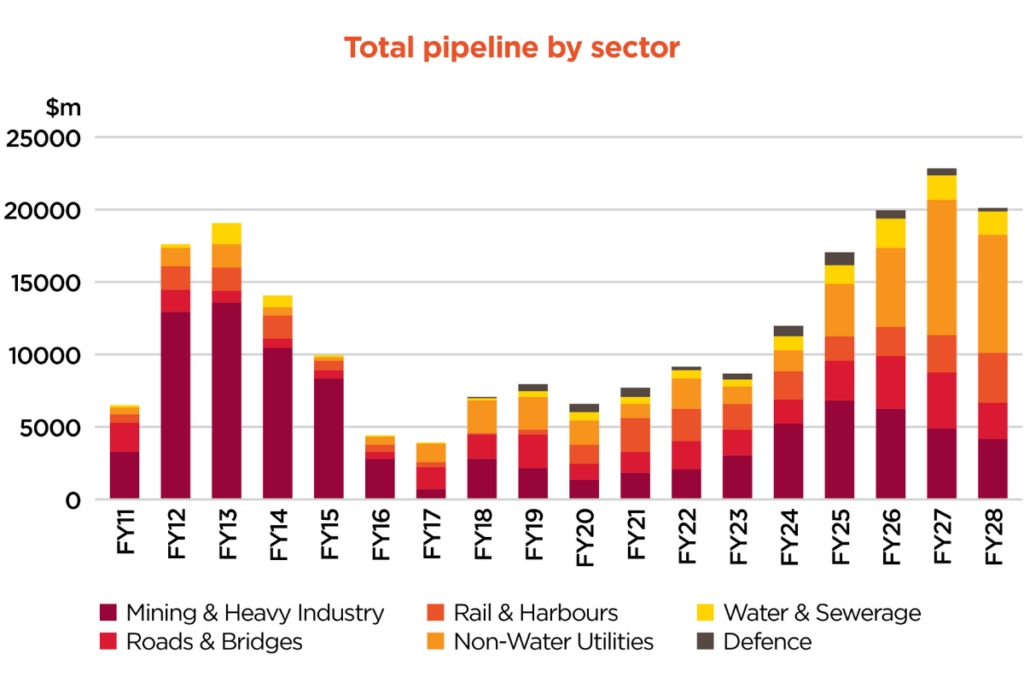

The total pipeline by sector graph highlights the change in the pipeline since 2010/11, where the mining and heavy industry sector (including gas) accounted for up to 80% of the spend; through to the prospect of the industry delivering a much more diversified spread of activity in excess of $20b annually from 2026. Unfunded work done on major projects over the next five years is $3.9b higher than 2022, at an aggregate value of $37.6b. The peak in unfunded activity has been shifted back (compared to the previous report) and is now anticipated for 2026/27 but will also remain elevated into 2027/28. The non-water utilities sector, reflecting the ‘energy transition’ infrastructure investment, is the biggest contributor to the net increase in unfunded activity and the sector has the second highest value of unfunded construction work (after mining and heavy industry).

Funded Work

Despite an overall improvement in the pipeline outlook for Queensland, the regional outcomes are varied. Funded activity rose in all regions except for Darling Downs-Maranoa and Ipswich-Toowoomba-Logan, while almost half of the regions experienced a decline in unfunded activity. The Ipswich-Toowoomba-Logan region was the only area to see a reduction in both the funded and unfunded construction activity over the next five years. In contrast, the remainder of South East Queensland (Brisbane, Sunshine Coast and Gold Coast) experienced a rise in construction work done that is sufficient to offset this decline. As with the 2022 QMPPR, the bulk of unfunded work is concentrated outside of Greater Brisbane, which raises the pipeline risk in these regions. The locations with the largest net gain in construction work over the pipeline are Wide Bay, Fitzroy and Brisbane – these regions represent 43% of activity.

Key Findings

The major projects pipeline continues to grow. In the five years between 2014/15 and 2027/28 inclusive, the major projects pipeline is valued at $92b. This is much higher than the previous two reports, whereby activity was $71.3b in the 2022 QMPPR and $61.9b in the 2021 QMPPR.$54.4b (59%) of the pipeline value is funded, up from $37.6b in 2022. $37.6b (41%) is unfunded, up from $33.7b in 2022. The share of unfunded projects grows across the pipeline from 13% in 2023/24 to 51% in 2027/28.

This introduces uncertainty about project development towards the end of the pipeline and calls for a more streamlined approval process.The public sector remains a key funder of major project work. 51% (up from 49%) of the total pipeline activity is attributed to the public sector, and the public sector represents 67% (down from 74%) of all funded work.2026/27 is on track to be the strongest year of work since the end of the resources boom in 2014/15, with the highest level of funded activity in the pipeline at $12b. If all unfunded work proceeds, total major project activity will surge to $22.9b and exceed the level of completed work seen at the peak of the resources boom in 2012/13 ($19.1b).

High construction costs coupled with rising domestic demand and supply constraints create barriers that can limit pipeline capacity. Road and bridge construction costs (as reflected by the ABS Road and Bridge Producer Price Index) continue to rise and are 7% higher than one year ago, with broader engineering construction costs remaining above historical averages. Increased input costs, labour shortages and reduced availability of materials and equipment pose a real risk to the construction of major projects and may result in extensive delays, or even cancellations.

Funded activity is expected to remain elevated over the pipeline, tapering off in 2027/28. Boosting growth in the industry (assuming supply constraints are able to be managed) can be achieved through securing unfunded projects in the pipeline.

Unfunded activity is anticipated to surpass $10b in 2026/27, with the private sector responsible for an average of $8.1b of unfunded projects per annum in the last three years of the pipeline. The mining and heavy industry sector makes up 57% of private unfunded work and the non-water utilities sector accounts for 41%.

Funded work is highly concentrated in ‘megaprojects’ (valued at over $1b). Megaprojects comprise over half (51%) of funded pipeline activity over the next three years, consistent with previous iterations of the report. However, the ratio of projects valued at under $200m has fallen to 7% of major project work over the next three years, compared to an average of 14% over the past four publications.

Major project outlooks differ considerably by region. Compared to last year, funded work has declined by 23% in the Ipswich-Toowoomba Logan region and 33% in Darling Downs-Maranoa, while increasing in all other areas. Wide Bay and Townsville have received the highest growth in pipeline funded work at 497% and 196%, respectively. Projects in the utilities (specifically electricity and defence) and mining and heavy industry sectors are the main drivers of this change.

Pipeline Risks

With Major Projects Pipeline construction activity significantly increasing over the coming years and potentially set to exceed levels seen during the mining and resources boom of 2011-15, capacity constraints may materialise as a downside risk. The heightened drought conditions have also been identified as a downside risk.

However, the outlook could experience upside risks should accelerated project deliveries be required for the 2032 Olympic and Paralympic Games and Queensland Government’s 2032 70% renewable target. residential and non-residential construction boom expected towards the end of the decade. Heightened construction cost escalation in recent years, with potential for further escalation in coming years, could also mean that some projects may need to be re-evaluated to determine their value for money. notable upside risk to the Major Projects Pipeline.

Despite the majority of Queensland’s planned $7.1b Olympic and Paralympic Games infrastructure spend tailored towards building projects, the desire to accommodate the event to the highest standard, and to impress the world stage, will necessitate the need for fast tracking of certain transport investments in time for 2032. It is noted that the State Government has yet to announce any of this.

The announcement of the transition back to the El Nino climate cycle, along with subsequent increased likelihood of severe drought conditions, are also a downside risk to the sector. These weather conditions may mean some infrastructure projects may be prioritised with timelines brought forward, or additional projects may be added. The need for long term bulk water supply and dam upgrades (including the dam safety upgrade program) provide for further upside.

The Queensland Government’s commitment to renewable generation targets poses an upside risk to the construction industry. With net zero emission targets of 50% by 2030, 70% by 2032 and 80% by 2035, increased investment in energy transition infrastructure such as high voltage transmission lines, renewable energy generation and pumped hydro energy storage and generation facilities will drive major investment for the sector for the next decade or more. As the country’s construction activity remains elevated, competition for materials and labour is identified as a downside risk. While the industry booms, interstate projects limit Queensland’s ability to deliver construction projects on time.

Cost Constraints

The construction industry experienced hyper-levels of cost escalation during 2022, fuelled by the rising cost of materials, logistics and energy exacerbated by the Ukraine War. During 2023, there has been a growing clamour that material costs are returning to normal levels and that cost escalation is, overall, returning to trend. But is that the case?

Before the pandemic, and going back as far as 2000, average construction cost escalation across Australia was about 3.2% per year. In Queensland, it’s been in the region of 3.5%. Cost escalation between 2019 and 2022 averaged 6.8% in Queensland – with the bulk of this falling in 2021 and 2022 where the levels of hyper-inflation were experienced most. 2022 alone saw construction cost escalation at 14.3%.

Expected normal construction escalation trend has been regarded as 3-4% per annum. This expectation is largely based on the assumption that many of the challenges of 2022 have now largely been resolved. However, while the cost of timber and steel has reduced significantly, materials such as sand, concrete, insulation, glazing, and floor coverings remain elevated. So, the narrative that material costs have returned to pre-pandemic levels is far from accurate.

It is also highly unlikely that cost escalation will return to trend in 2024 and beyond (which several forecasters are currently predicting). This is due to several prevailing factors and a growing list of challenges:

- An unprecedented pipeline of government investment (largely transport and social infrastructure) that is yet to hit the market

- A construction supply chain that is already stretched thin with a growing number of industry insolvencies

- There is too much work and not enough people to deliver it

An unprecedented and growing housing crisis - The growth in public sector spend will only make it more difficult for private sector clients to compete for contractors and trades, likely resulting in costs rising further as demand increases and once the private sector recovers. This is exacerbated using Best Practice Industry Conditions, which effectively adds a significant premium to project labour costs.

Ultimately, increasing demand for labour and skilled workers is now beginning to outstrip supply – and with the investment in the Hospital Capital Expansion Program and the 2032 Olympic and Paralympic Games not yet hitting the ground, this situation will only become more challenging. Before the pandemic, and going back as far as 2000, average construction cost escalation across Australia was about 3.2% per year. In Queensland, it’s been in the region of 3.5%.

Cost escalation between 2019 and 2022 averaged 6.8% in Queensland – with the bulk of this falling in 2021 and 2022 where the levels of hyper-inflation were experienced most. 2022 alone saw construction cost escalation at 14.3%. Based on this, construction cost escalation is unlikely to return to trend any time soon. This will have ongoing impacts on budgets and forecasts for future projects. Expected normal construction escalation trend has been regarded as 3-4% per annum. This expectation is largely based on the assumption that many of the challenges of 2022 have now largely been resolved. However, while the cost of timber and steel has reduced significantly, materials such as sand, concrete, insulation, glazing, and floor coverings remain elevated. So, the narrative that material costs have returned to pre-pandemic levels is far from accurate.

Industry Capacity and Capability Issues

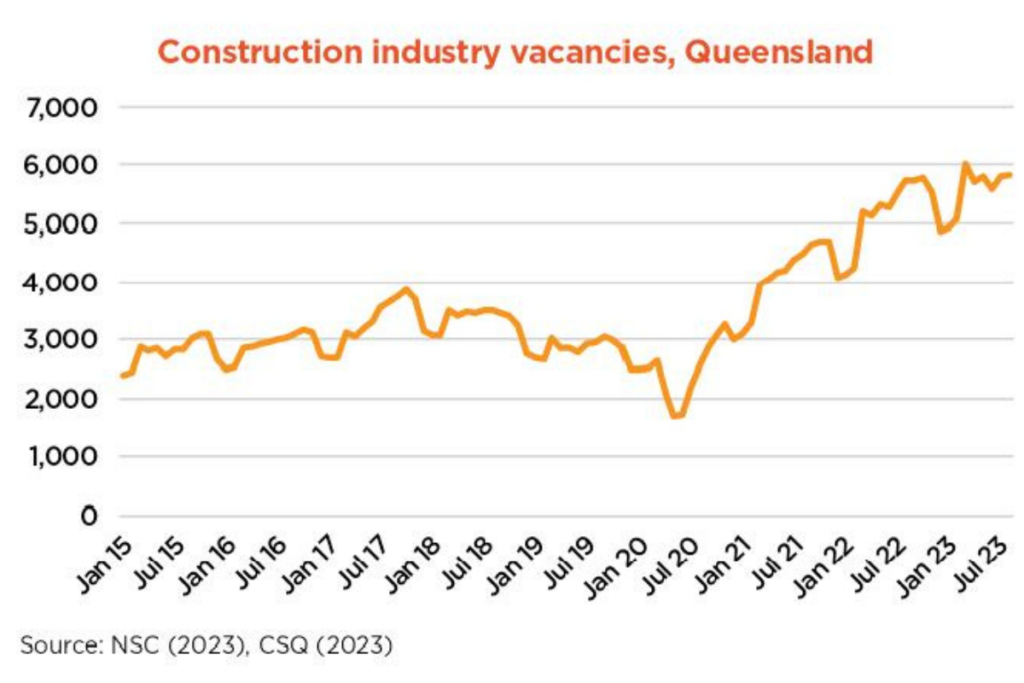

Queensland is stepping into its next wave of construction activity. A growing population, 2032 Olympic and Paralympic Games and the state’s ambitious net zero transition will drive construction activity over the coming years. The significant volume of work will add to an already bulged infrastructure pipeline and further intensify the state’s long-running workforce challenge. An estimated 33,515 workers on average will be required from now out to 2027/28 to deliver the state’s incredible pipeline of civil work.

The average requirements for the funded and unfunded segments are almost the same. Unfunded projects will likely need 17,022 workers, marginally more than the 16,493 workers needed for the funded domain. The peak labour demand across funded and unfunded projects is expected to occur in 2027/28 at an average of 43,702 workers. This is a significant 78% surge relative to the average workforce requirements in 2023/24. Regional and remote Queensland will face stronger labour demand with most of the renewable energy projects located in these parts of the state.

Around 70% of the labour demand will be in these areas where the workforce challenges have always been exacerbated. Electricity, telecommunications and water projects are expected to dominate labour demand across the project types. Notably, electricity projects will require almost 10,000 workers on average, twice the number of workers needed in telecommunications and water projects.

All occupations in the construction bucket will be highly impacted. The labour requirements are spread across the different occupations, with most expected to require more than 1,000 workers on average over the next five years, with most of these being civil construction jobs.

The significant new volume of capital work will add to an already inflated infrastructure pipeline and further intensify the state’s long-running workforce challenges. There is already a significant backlog of around $18b of unfinished projects in the civil pipeline, 60% of which are public projects. This pipeline has grown post-pandemic and currently sits at a new record high.

Adding to this is the state’s buoyant building activity. While the residential segment has slowed as expected, commercial building activity has turned out stronger, with recent data showing a significant 32% surge in approvals. The labour market challenges refuse to budge despite the growing demand. Supply bottlenecks remain amidst the significant surge in labour demand. Construction industry employment is only 13% more than the pre-pandemic level.

This slow pace of growth is insufficient given the mounting volume of residual and new work in the pipeline. The persistent unfilled construction vacancies, which are twice the levels seen before the pandemic, reflect the industry’s struggle in finding workers. Unfilled vacancies have grown across all regions of the state. Most of the open vacancies reflect jobs essential to civil projects. These include electricians, structural steel and welding trade workers, and earthmoving plant operators.

Productivity

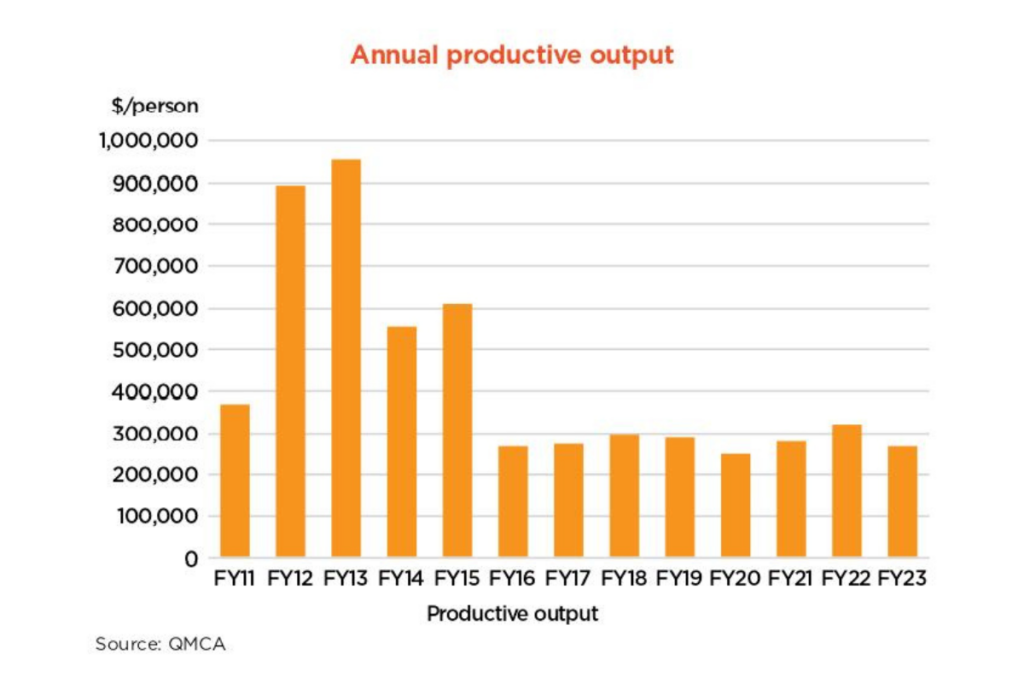

Across the nation, the construction industry is experiencing a productivity conundrum. We are delivering less at a higher cost compared to 10, 20, even 30 years ago, and the issue is exacerbated further in Queensland.

In the five year period between 2011 and 2015, the state’s engineering and construction sector delivered on average ~$13.5b of work annually with a corresponding average workforce of close to 20,000 people. This equates to an average output of $679k/person. In the following five year period from 2016 to 2020, the workforce increased to 21,600 people on average, but our annual output per person employed dropped to $276k/person. The resources boom of the 2012 to 2015 period involved substantial use of modularisation and other productive construction techniques, which have yet to be further deployed in scale across the industry. This accounts for some of the higher productivity measures during this time.

In the period after the resources boom, Queensland lost a large portion of skilled workforce to the southern states as they commenced large construction programs. A significant number of these workers are largely yet to return to Queensland.

The challenge for the industry in Queensland is to find a way to improve productivity in the short- to-medium term to deliver better value for money, while at the same time sustaining the gains created during this period.

Productivity Impacts

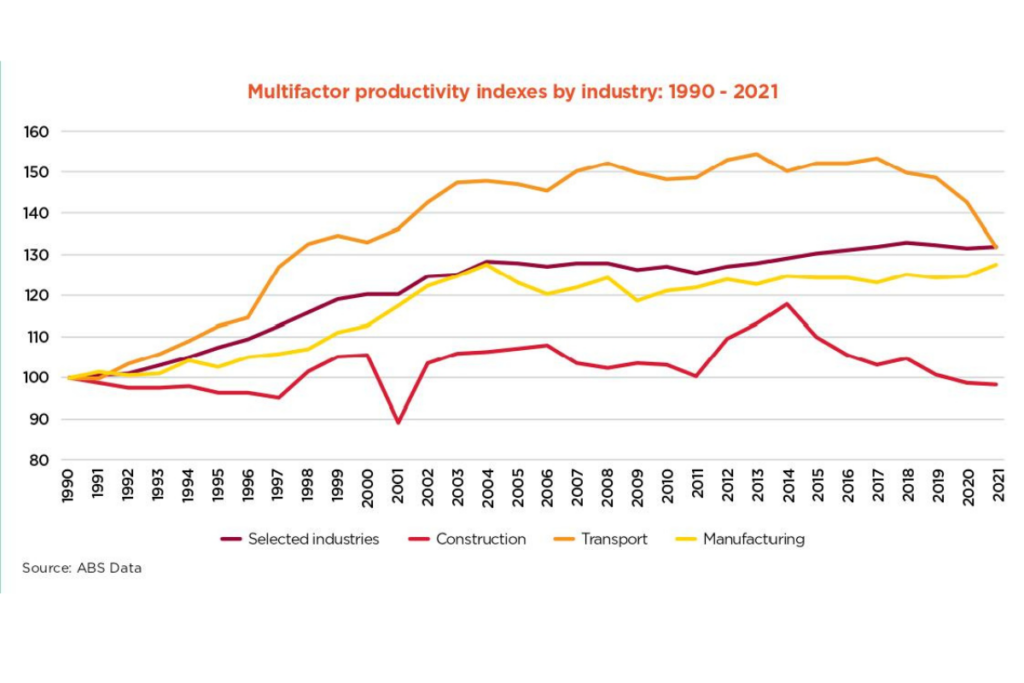

Productivity across the construction sector has been on the decline since 2014, now sitting lower than rates recorded back in 1990. This decline is further compounded when compared to industries such as manufacturing which, despite slightly decreasing over the past five years, have seen a 30% increase since 1990.

Recently, the Commonwealth Government released an inter-generational report which cited the following:

- Average labour productivity growth is at a 60-year low, with just 1.1% growth from 2010 – 2020

- Despite technological optimism, annual productivity growth is projected at only 1.2% over the next 40 years

- Economic growth is expected to slow down to an average of 2.2% per year.

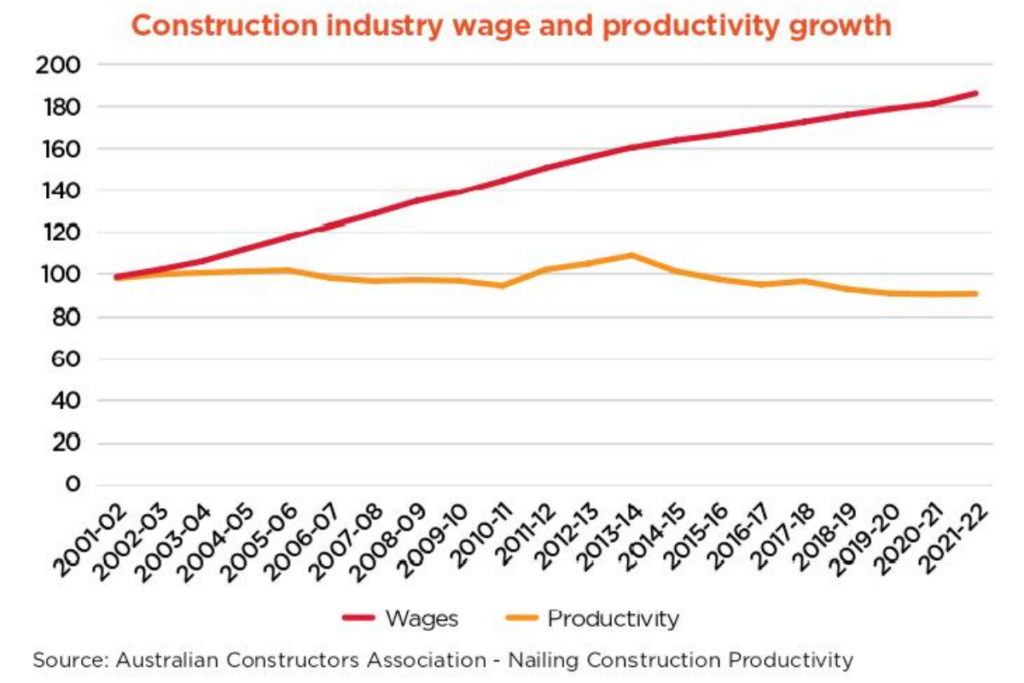

Wage and productivity growth have increasingly separated since the early 2000s, and this ongoing disconnection amplifies the challenge of achieving value for money.

With the Queensland Government’s intrusion into Industrial Relations (IR) arrangements via the Best Practice Industrial Conditions (BPIC) policy, construction wages are set to increase by 20-30%. In contrast, productivity is expected to decrease by a similar amount if the conditions included in BPIC are implemented. This will result in a substantial reduction in the value for money equation.

To be able to deliver the pipeline, productivity will be the challenge. The increase in cost against the drop in productivity, with ongoing labour shortages going forward presents a significant hurdle. What we know and can work with, is that the Queensland construction sector’s productivity is being impacted by the following key areas:

- Procurement

- Industrial relations

- Adoption of technology and new specifications.

In light of this, a recommended solution for each key area is to promote collaborative efforts among clients, engineers, contractors and third parties. The objective is to gain a strong start to project delivery with collaborative procurement and contracting processes implemented as early as possible, to ensure that appropriate industrial conditions that engender productivity are included, as well as the adoption of initiatives and technology that will drive value for money.

Collaboration

Procurement

Collaborative procurement and contracting is an effective way to start to address these productivity challenges. Typically, the procurement process has involved contractors having to develop a firm price considering all the relevant project risks and opportunities over a 4 – 12 week period. This period of time has shown to be insufficient to develop a strong understanding of price associated with the risks and opportunities. It is often based on unreliable information and the time is not adequate for thoroughly exploring where risks should be allocated between parties and how to overcome them.

A collaborative procurement process invites diversity of thought and a mutual understanding and sharing of the risks and opportunities involved. The current approach requires parties to price the risk, without the benefit of the information developed through the planning stages. It also doesn’t allow enough time for considering appropriate and innovative solutions to evolve in order to successfully manage the risks. When less productive procurement processes such as this have been adopted, additional costs are incurred and longer delivery times ensue. To remedy this, embracing a more collaborative procurement process will set up projects for success. The outcomes from collaboration tend to generate more suitable innovative solutions to risks, and by identifying opportunities early on, methods to improve productivity are considered up front. When these outcomes have been achieved by mutual input from both parties, it is more likely that better value for money can be achieved.

Industrial Relations (IR)

The civil construction IR environment has remained relatively stable for a lengthy period of time. This is mainly due to the positive working relationship between employers, employees and their representatives. Since 2020, the introduction of BPIC policy by the Queensland Government has disrupted this harmonious working relationship. The BPIC policy and ‘guidance information’ has set a new ‘high floor’ for construction rates, extending across the entire sector during times where companies are competing for labour. Additionally, the BPIC policy outlines the conditions upon which work will be undertaken – conditions that have already impacted productivity – with projected times for work being affected and up to 20-30% of additional project costs incurred.

BPIC does not benefit productivity, effectively widening the gap between wage and productivity growth. It has resulted in the industry delivering less for more money, over longer time periods and has removed the workable nexus between employees, employers and their representatives. The conditions BPIC has introduced are at base levels that don’t accurately reflect where the industry is currently at. From an IR perspective, solutions could be derived through collaboration between employers, employees and their representatives, however, BPIC restricts this unified approach, stymieing productivity.

Adoption of Technology and New Specifications

The construction sector is often referred to as a ‘technology laggard’. This is a moderately accurate reflection on the state of technology adoption when compared to other industries.

While parts of the engineering and construction sector have higher technology adoption than others, there is more work required to reap the benefits of significant productivity gains. Technology options have the capacity to improve productivity across the sector in ways such as:

- Greater use of modularisation, especially in the resources sector and commercial building

- Greater digitisation deployment of engineering information from planning and design phase, through to construction and operations

- Automated plant operations including earthmoving, paving and craneage

- Use of Artificial Intelligence (AI).

Clients, engineers, contractors and third parties – such as technology providers – are encouraged to work together to set technology more in motion in project delivery. The time has come to adopt new technologies to create safer workplaces, remove human error, improve efficiency, and increase productivity.

In addition to overcoming this lag in technology adoption, we also need to consider how specifications that are too rigid do not encourage industry to offer innovative solutions and alternatives that can improve productivity. Again, collaborative project planning and delivery enables consideration of innovative options that will deliver time and cost savings without affecting quality. This has shown to equate to much higher productivity, and when we start seeing this happening industry-wide, it will create the framework that enables construction project teams to look at alternative options and ideas with clients that can deliver productivity benefits.

Our Supporters

Thank you to our supporters, without whom the 2023 QMCA CSQ Queensland Major Projects Pipeline Report would not be possible.

CONSTRUCTION SKILLS QUEENSLAND

Platinum Partner

Construction Skills Queensland (CSQ) partners with major projects to develop a ready supply of skilled workers for every stage of these high-impact bodies of work. CSQ helps industry understand future workforce requirements and supports targeted workforce plans that provide security and sustainability to project budgets and timeframes.

Because each region and project is unique, CSQ champions local training solutions tailored for individual project demands.

Our research and analysis empowers industry with a line of sight to the future to stay one step ahead of potential challenges.

CLOUGH

Gold Partner

We harness innovative engineering and construction solutions to improve peoples’ lives today and tomorrow.

We deliver high performing assets for the energy, resources and infrastructure industries, underpinned by a dedication to innovation, sustainability and getting the job done safely and efficiently.

Our workforce of over 3,000 people across Australia and Asia Pacific is committed to delivering exceptional projects for our industries and communities, as a partner for a sustainable future.

Following the acquisition by global construction leader Webuild in 2023, Clough Group became the Australian subsidiary of Webuild Group.

WESTERN DOWNS CIVIL

Gold Partner

Western Downs Civil is based in Queensland’s Surat Basin. WDC is a diversified civil infrastructure company with project delivery capability across a range of industry sectors. Current projects are in the oil & gas, renewable energy, power & battery infrastructure.

Our goal is to create a longstanding partnership with your business to ensure the successful delivery of your projects. WDC focuses on building strong, ongoing relationships with clients since 2013 indicates our commitment to client satisfaction and project success.

Providing civil construction, earthworks, roadworks & plant hire services.

BENNETT + BENNETT

Regional Partner - Brisbane and Toowoomba

Established in 1968 on the Gold Coast, Bennett + Bennett have been privileged to play a significant role in key projects and areas of development legislation which have helped shape South East Queensland. Our success and longevity within the industry comes from our experience, and ability to work with an outstanding array of clients who continue to put their trust in us. Through collaboration, ongoing improvement, upskilling and technology investment we are able to adapt our services to best meet their changing needs, whilst ensuring we remain current in an evolving market.

John Holland

Regional Partner - Brisbane

We’re Australia and New Zealand’s leading end-to-end integrated infrastructure, building, rail and multi-modal transport company.

Our diverse sector experience enables us to create innovative, enduring and cost-effective solutions for our customers.

Our people-first philosophy has put us at the front of the market and continues to attract the best talent.

We’re proud of the part we play in Australia’s economy. In fact, we contributed some $12.5 billion to Australia’s GPD between 2016 and 2020 and we’re set to do the same over the next four years.

STANWELL

Regional Partner - Toowoomba and Gladstone

We are a major provider of electricity and energy solutions to Queensland, the National Electricity Market and large energy users throughout Australia.

We’re putting our energy into finding better, cleaner ways to reliably generate, store and move electricity for our customers. Through our pipeline of proposed renewable energy projects throughout central and southern Queensland we’ll reduce our emissions intensity and create future opportunities for our people and communities.

At Stanwell, we provide the spark for a bright future. That future starts now.

Find out more at Stanwell.com

BMD

Regional Partner - Townsville

BMD Constructions is a wholly owned subsidiary of the BMD Group, and provides civil and industrial construction services to public and private sector organisations throughout Australia. Established in 1979, BMD Constructions strives to be deliberately different in its approach to business with every project being regarded as an opportunity to build long term relationships of mutual benefit.

SUNWATER

Regional Partner - Townsville

Sunwater is a water service provider, making the most of the available water supply for our agriculture, urban and industrial customers. We operate 365 days a year to deliver for our customers. We understand the essential role our customers play in regional growth and prosperity.

DEGNAN

Report Supporter

Recognised as one of the most client-focused Australian-owned construction companies for challenging infrastructure, we offer solutions based on collaboration and a commitment to excellence.

For more than 40 years Degnan has successfully been delivering specialised solutions for challenging and unique projects, particularly in rail infrastructure and first-of-type projects.

STRATAGILITY

Report Supporter

stratagility provides proven commercial, transaction and supply chain advisory and strategy methodologies tailored to meet individual customer objectives across the infrastructure, energy, resources, oil and gas, renewables and engineering sectors.

With global experience and local knowledge, stratagility can help you meet your project or organisation’s individual strategic objectives. stratagility are the on demand experts that your organisation needs. To discover how stratagility can help you achieve the best commercial outcomes, please reach out to us at – email: enquiries.rigo@stratagility.co | telephone: +61 1300 866 102. www.stratagility.co

TOOWOOMBA AND SURAT BASIN ENTERPRISE

Event Partner - Toowoomba

TSBE is an independent, member-driven economic development organisation actively linking our business community to opportunities across the Toowoomba, Western Downs, Maranoa and surrounding areas.

TOWNSVILLE ENTERPRISE

Event Partner - Townsville

For over 25 years Townsville Enterprise has been a key driver in attracting major investment to the region. It ensures that Townsville, Magnetic Island, Palm Island, the Burdekin Shire, the Hinchinbrook Shire and the Charters Towers region benefit from investment and economic prosperity, tourism opportunities and the business events market.

GLADSTONE ENGINEERING ALLIANCE

Event Supporter - Gladstone

Gladstone Engineering Alliance is the reputable self-funded not for profit organisation linking business with opportunity to create sustainable growth and diversity for the Gladstone Region.

We have a significant proven track record in running diversified private and public grants and projects with excellence. Our diverse capabilities stem from many years of project management assisting organisations of all sizes from the SME’s and global corporations. We have a history of successfully utilising government funding to deliver programs that provide lasting benefits and skills to their participants, businesses and the wider-community.

GEA is a well-established organisation that has been operating since 2003 and has a commitment to assist the Engineering, Manufacturing and Supply Chain Services of the Gladstone Region to meet world best practice for skills, proficiency, capability, and quality of work.