2022 Queensland Major Projects Pipeline Report

The QMCA CSQ Queensland Major Projects Pipeline Report (QMPPR) provides a comprehensive list of major engineering construction projects, alongside an analysis

of the corresponding level of construction activity taking place during the year. Proudly supported by Construction Skills Queensland, Bennett and Bennett, BMD and ARTC Inland Rail, Bielby Hull QBirt Joint Venture, Townsville Enterprise and Toowoomba Surat Basin Enterprise.

The QMPPR provides a comprehensive list of major engineering construction projects, together with analysis on the corresponding level of construction activity. Activity is based on both the completion of existing projects and the likelihood of potential projects proceeding.

- DOWNLOAD THE REPORT EXECUTIVE SUMMARY

- DOWNLOAD THE FULL QUEENSLAND MAJOR PROJECTS PIPELINE REPORT

- DOWNLOAD THE REPORT DATA SETS

- DOWNLOAD THE PRESENTATION PACK – BRISBANE

- DOWNLOAD THE PRESENTATION PACK – TOWNSVILLE

- DOWNLOAD THE PRESENTATION PACK – TOOWOOMBA

The analysis is based on the completion of existing projects and an assessment of the future projects that are likely to go ahead.

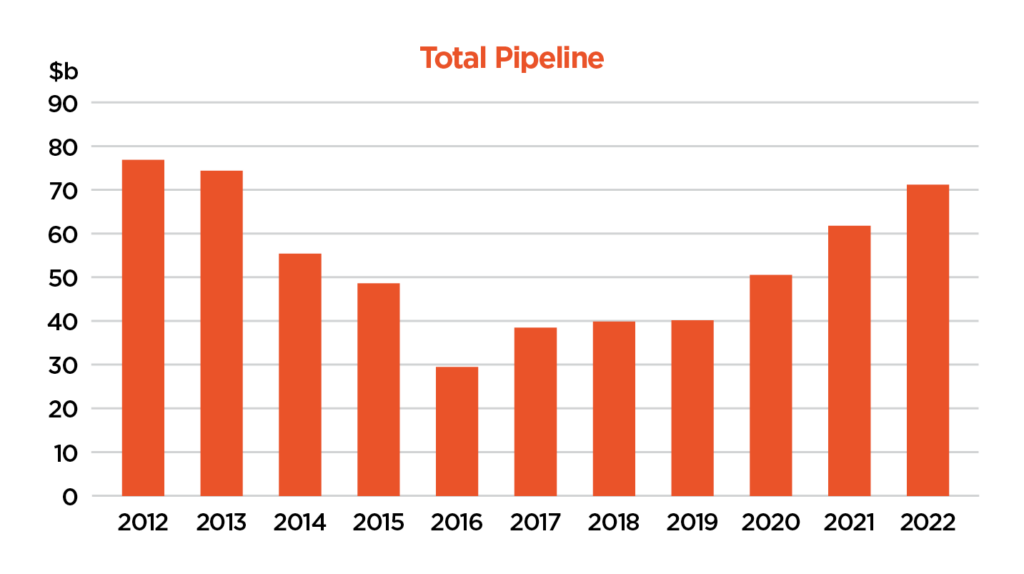

For the past 11 years, the five-year pipeline has dramatically changed from $77b in 2011 that was heavily influenced by resource and energy investment from 2010 – 2015. In the wake of this boom the pipeline fell away, along with investor and industry confidence.

New South Wales and Victoria gained a steady march on Queensland from 2015 onwards, with large scale investment programs in public infrastructure propelling these states forward.

Since 2019, we have seen a return to investment in critical infrastructure in Queensland and this is reflected in today’s pipeline increase to $71.3b.

What the pipeline is now showing is increased investment in energy storage and renewable energy, and significant spending on public infrastructure. In the longer term, hydrogen projects will also add to the pipeline.

The headline figure of the five-year pipeline has slowly returned to that of 2012/13. With Olympic related infrastructure yet to be factored in, a level of confidence is returning to the industry, however, the headwinds on the horizon for the engineering and construction industries require level-headed and wise navigation.

For the pipeline to be delivered successfully, how two critical issues play out will determine the reality of what can be achieved. They are:

Productivity, skills and resources.

This year’s report highlights these areas and provides the foresight required for adequate preparation.

Key Findings

The major projects pipeline continues to grow. In the five years between 2022/23 and 2026/27 inclusive, the major projects pipeline is valued at $71.3b. This figure is much higher than the growth reported over the last two years, whereby 2021 reported $61.9b and 2020, $50.8b. $37.6b (53%) of the pipeline value is funded, up from $35.5b in 2021.

47% of the pipeline is unfunded, up 26% in 2022/23. This does create a level of uncertainty with respect to further progression of projects in the pipeline to financial decisions. There needs to be a focus on how projects can be approved and funded in a more streamlined manner.

The public sector remains a key funder of major project work. 49% of the total pipeline is funded by the public sector and represents 74% of all funded work.

2022/23 has the potential to be the strongest year of major project activity since the end of the resources boom in 2013/14 – a trend we have seen across recent QMPP reports. The total of funded and unfunded activity is projected to be $14.7b. If all unfunded works go ahead, total major project activity will have more than doubled the 2019/20 figure. It will also eclipse the total 2013/14 total by 4%. The present-day total, however, is still well below the record $19.5b worth of major project work that was set in 2012/13 at the peak of the resources boom.

The 4 C Challenge – Capacity, Capability, Costs and Carbon

The 2022 QMPPR holds a promising outlook for major project activity in Queensland. Whilst current funded activity peaks in 2022/23, the substantial increase in unfunded work beyond this year, suggests there is a real possibility of major project activity growth that will maintain an upward trajectory in the coming years.

There are, however, considerable risks to the outlook. After a period of lagging behind east coast rivals of New South Wales and Victoria, Queensland is now pursuing infrastructure investment at a time when capacity and capability to deliver has been undermined by supply chain disruptions and surging input costs. While the broader economy and society seek to embrace a new and emerging ‘post-Covid’ normal, supply chain activity for the major project industry remain about as far from normal as they can get.

Labour shortages are widespread and this affects construction trades, professions, and unskilled labour from enduring years of border closures and disrupted education and training. The unskilled labour pool is vital to fulfilling both direct and indirect construction jobs. Materials and equipment suppliers are also hampered by rising costs and delays in the delivery of critical machines, parts and components from overseas, as industrial production sputters towards recovery and international freight costs have increased 7-8 times over previous levels. These challenges have the potential to see major project work in the pipeline ‘re-profiled’ to mitigate capacity, capability and cost risks, or at worst case scenario – cancelled.

The risk that infrastructure investment fails to keep pace with Queensland’s impressive, nation- leading rate of population growth is a concern, especially with the need to provide infrastructure that will support the 2032 Olympics. Furthermore, these challenges may prevent timely investments in renewable energy solutions, in turn helping Australia meet its total carbon emission reduction targets.

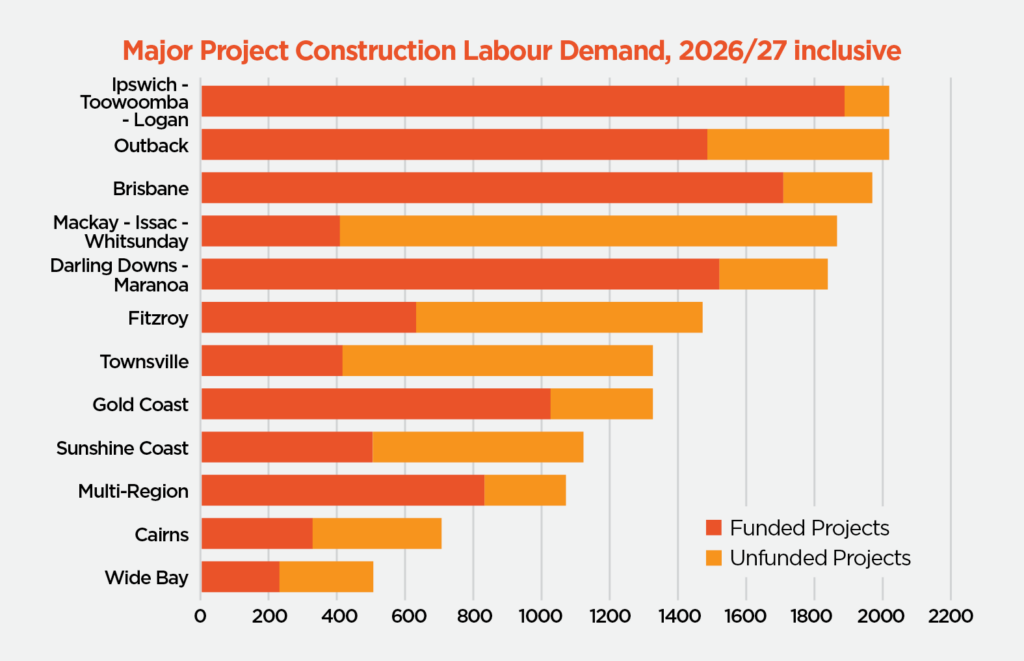

The $71.3b pipeline could require 16,200 construction workers on average from now until 2026/27, to include skilled trades, professions and unskilled labour. More workers are predicted for the funded component (approx. 10,800) which leaves 5,400 for unfunded works. Most of the worker demand will be in regional and remote Queensland, accounting for an estimated 60 to 80%.

Renewable energy is well- positioned to pick up over the long-term. As Queensland transitions to net zero and pursues a large-scale hydrogen export industry, CSQ estimate this could require $13.9b annual investment over the next 30 years. This will catalyse an almost permanent demand for civil construction labour, with an estimated 14,500 to 26,700 new jobs possibly required, more than half of which will be in regional and remote Queensland.

The $71.3b pipeline will be delivered under tight labour market conditions, with trade demand already very high due to the pandemic. A $16.3b pipeline already confronts Queensland’s civil construction sector which is 55% growth from pre-pandemic times and is the highest point since the mining boom ended.

70% is publicly funded and reflects initiatives like the state government’s recovery plan and record transport investment. Unprecedented demand for critical civil trades has followed – more than 1,000 job advertisements in the most recent month.

The ‘normal’ rate is less than 500, yet this figure continues to grow, with many roles required in regional and remote Queensland. The supply side for both labour and training has not responded. Employment in the Queensland civil construction sector (currently 21,600 workers) remains 20% below pre-pandemic levels.

These figures have deteriorated since the pandemic began, even while broader industry employment show signs of recovery. Regarding training, a record-breaking intake of construction apprentices (driven by the pandemic wage subsidy program) has been mainly a residential phenomenon. This has inadvertently crowded the normal proportion of construction apprentices choosing to train in the civil and infrastructure sector, with that proportion now running at about half relative to 2019.

Recommendations

The QMPPR presents a number of measures for consideration that are targeted at boosting supply and mitigating the ‘4C’ risks to government and industry. Perhaps more crucially, these recommendations are intended to help re-spur growth in productivity which is necessary in order to meet the 2023 QMPPR projections.

Increasing Supply

- Skilled migration will assist with addressing current skills shortages in construction and related input industries, as will speeding up the visa approval system and clearing application backlog.

- Commonwealth and State Governments need to agree on substantial increases in education and training investment toward building and construction trades and professionals.

- Government and industry should support initiatives that promote diversity and participation.

- It is the responsibility of both state and local government to ensure quarry capacity (and developments in recycled materials) keep pace with infrastructure demands.

Boosting Productivity

- Governments are encouraged to continue to seek approaches that are collaborative and bring long-term value to tendering and procurement.

- Innovation in the way major projects are funded, financed and procured requires government attention.

- Queensland Government agencies need to adhere to principles for lean construction.

- Governments should work with industry to continue to standardise terms, contracts and procurement models as much as possible.

- Both industry and government need to collaboratively find innovative solutions for life-cycle infrastructure standards that ensure sustainability.

Positioning Queensland for Sustainable Long-Term Growth

- Queensland and Commonwealth government agencies are expected to work with industry to best allocate and share unusual price escalation risks to support industry sustainability, particularly for firms exposed on fixed price contracts.

- Government agencies need to consider either accelerated and/or advanced payments to secure purchase and storage of materials and equipment.

- The Queensland Government would do well to transition to more stable, growing revenue streams for funding infrastructure.

- The development of a suite of policies to reduce the carbon footprint of the construction industry in Queensland, is the Government’s and industry’s shared responsibility.

- It is recommended that National and State Governments include resilience/adaption work in infrastructure audits, and develop a list of ‘at risk’ infrastructure.

- National and State Governments need to consider ways that regulated utilities can be provided appropriate funding.

Our Supporters

Thank you to our supporters, without whom the 2022 Queensland Major Projects Pipeline Report would not be possible.

CONSTRUCTION SKILLS QUEENSLAND

CSQ monitors key industry trends and actively tracks Queensland’s pipeline of major projects to inform and guide the development of workforce planning and training solutions for Queensland’s building and construction industry

BMD

BMD Constructions is a wholly owned subsidiary of the BMD Group, and provides civil and industrial construction services to public and private sector organisations throughout Australia. Established in 1979, BMD Constructions strives to be deliberately different in its approach to business with every project being regarded as an opportunity to build long term relationships of mutual benefit.

BENNETT + BENNETT

Established in 1968 on the Gold Coast, Bennett + Bennett have been privileged to play a significant role in key projects and areas of development legislation which have helped shape South East Queensland. Our success and longevity within the industry comes from our experience, and ability to work with an outstanding array of clients who continue to put their trust in us. Through collaboration, ongoing improvement, upskilling and technology investment we are able to adapt our services to best meet their changing needs, whilst ensuring we remain current in an evolving market.

TOWNSVILLE ENTERPRISE

For over 25 years Townsville Enterprise has been a key driver in attracting major investment to the region. It ensures that Townsville, Magnetic Island, Palm Island, the Burdekin Shire, the Hinchinbrook Shire and the Charters Towers region benefit from investment and economic prosperity, tourism opportunities and the business events market.

TOOWOOMBA AND SURAT BASIN ENTERPRISE

TSBE is an independent, member-driven economic development organisation actively linking our business community to opportunities across the Toowoomba, Western Downs, Maranoa and surrounding areas.

ARTC Inland Rail

Inland Rail is a fast freight backbone that is transforming how goods are moved around Australia, generating opportunities for our regions and our economy, now and well into the future.

Spanning more than 1,700km and comprising 13 individual projects, Inland Rail is the missing link in our national freight network, providing transit times of less than 24 hours for freight trains between Melbourne and Brisbane via regional Queensland, New South Wales and Victoria.

During construction it will create more than 21,500 jobs, including more than 11,800 in Queensland. Work on Inland Rail is well underway, with the Parkes to Narromine section in NSW commissioned in September 2020.

The Australian Government has committed funding for the Australian Rail Track Corporation (ARTC) to build Inland Rail, in partnership with the private sector.

BHQ Joint Venture

The BHQ Joint Venture comprises Bielby Holdings, JF Hull Holdings and QH&M Birt. Bielby is a wholly-owned and operated Queensland based civil engineering company providing leading infrastructure design and construction expertise to clients across Australia.

Bielby specialises in engineering solutions in the Road, Rail, Ports and Marine, Aviation, Resources and Renewable Energy sectors.

JF Hull Holdings is a civil engineering contracting organisation specialising in the field of concrete construction. With its foundation in concrete construction, JF Hull has grown to deliver some of the most challenging infrastructure projects, providing expertise in bridge works, roadworks, drainage and structural steelwork.

QH&M Birt has grown to become a dynamic provider in the Civil Construction and Mining Industries, with a diverse range of projects completed throughout Queensland, Western Australia, the Northern Territory, New South Wales and the ACT.