2021 Queensland Major Projects Pipeline Report

The QMCA is proud to provide the 10th instalment of the Queensland Major Projects Pipeline Report (QMPPR). Developed in conjunction with BIS Oxford Economics; over the past decade, the QMPPR has become the barometer of current and future major project activity and construction industry conditions in Queensland and is proudly supported by Bennett and Bennett, BMD and ARTC Inland Rail

The QMPPR provides a comprehensive list of major engineering construction projects, together with analysis on the corresponding level of construction activity. Activity is based on both the completion of existing projects and the likelihood of potential projects proceeding.

- DOWNLOAD THE REPORT EXECUTIVE SUMMARY

- DOWNLOAD THE FULL QUEENSLAND MAJOR PROJECTS PIPELINE REPORT

- DOWNLOAD THE REPORT DATA SETS

- DOWNLOAD THE PRESENTATION PACK

A complete list of major projects considered for this analysis, and the explicit assumptions for each project regarding work done, and construction workforces employed each year, are provided in this report. Infrastructure provision is critical to maintaining Queensland’s economic health and growing the economy. It’s just as important to maintaining and improving the quality of life for Queenslanders, connecting communities and providing essential services.

The QMPPR tracks major investments in economic infrastructure including transport, utilities, defence and resources assets.

The economic benefits of timely and adequate infrastructure provision are well documented.

At the macroeconomic level, the development and delivery of infrastructure provides a welcome boost to employment and economic activity.

But infrastructure investment also has a critical microeconomic role. Through good project selection, investment in economic infrastructure can be a powerful determinant of productivity growth and productive capacity for the Queensland economy in the long term.

Over the past decade, the volatile performance of the major projects market in Queensland, and the broader Queensland economy, can be put down to the impact of large, long cycles of investment, across both the public and private sectors.

A Positive Outlook

- The five-year pipeline is $11.3b larger than in April 2020.

- $8b of the increase comes from funded projects.

Funded major project work: in brief

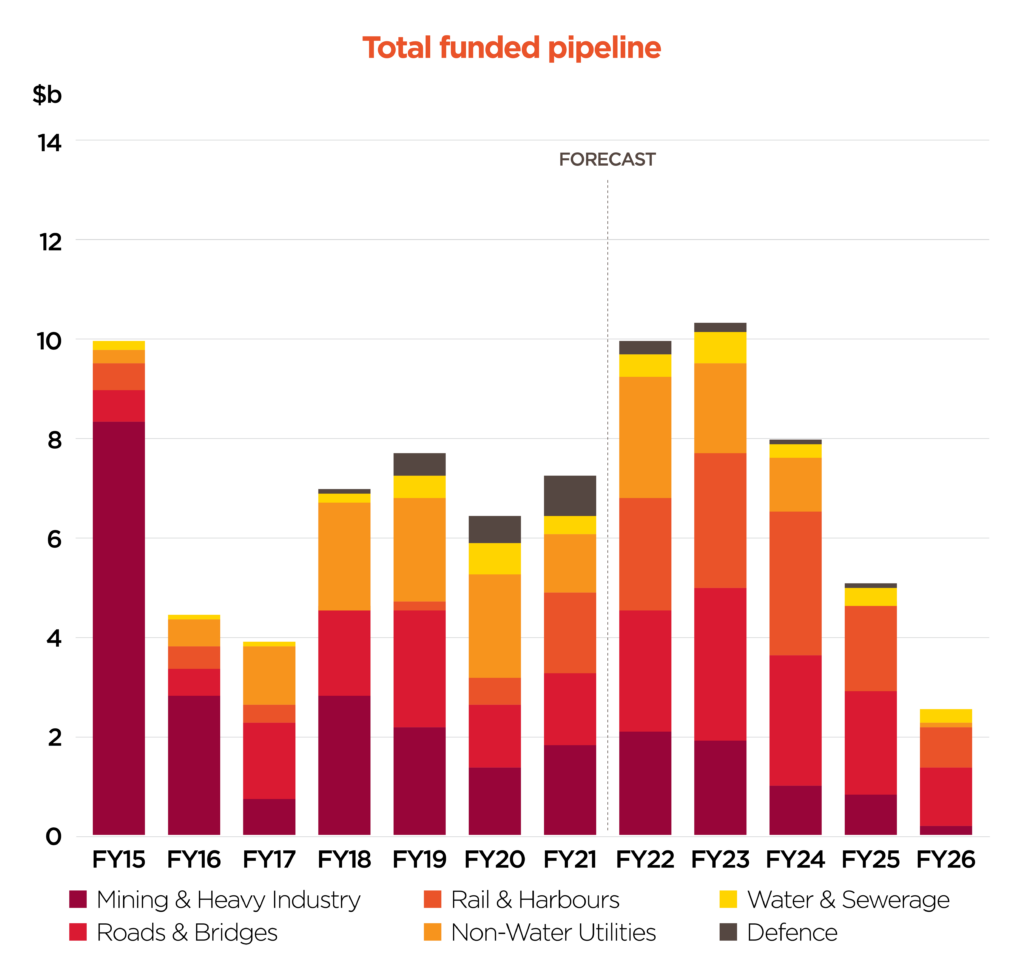

- Strongest growth is in Roads and Non-water Utilities sectors.

- Road work has risen from $7b in April 2020 to $11.5b.

- Non-water Utilities projects have risen 95% from $2.3b to $5.5b on the back of renewable energy projects and NBN ongoing investment.

- Mining and Heavy Industry activity rose from $4b to $5.4b.

- Activity in Railways, Harbours and Defence is slightly lower than in April 2020.

- Almost half of all funded activity – and two-thirds of funded transport activity – occurs within the South East Queensland (SEQ) region.

- Brisbane and the broader SEQ region remain critical for funded major project activity even though its share of activity is lower than in 2020.

- Outside of the SEQ region there are still substantial risks to the pipeline given the higher share of unfunded work: many of the major projects in regional Queensland are Resources and Energy based where global market factors still heavily influence short- to medium-term investment decisions.

Key Findings

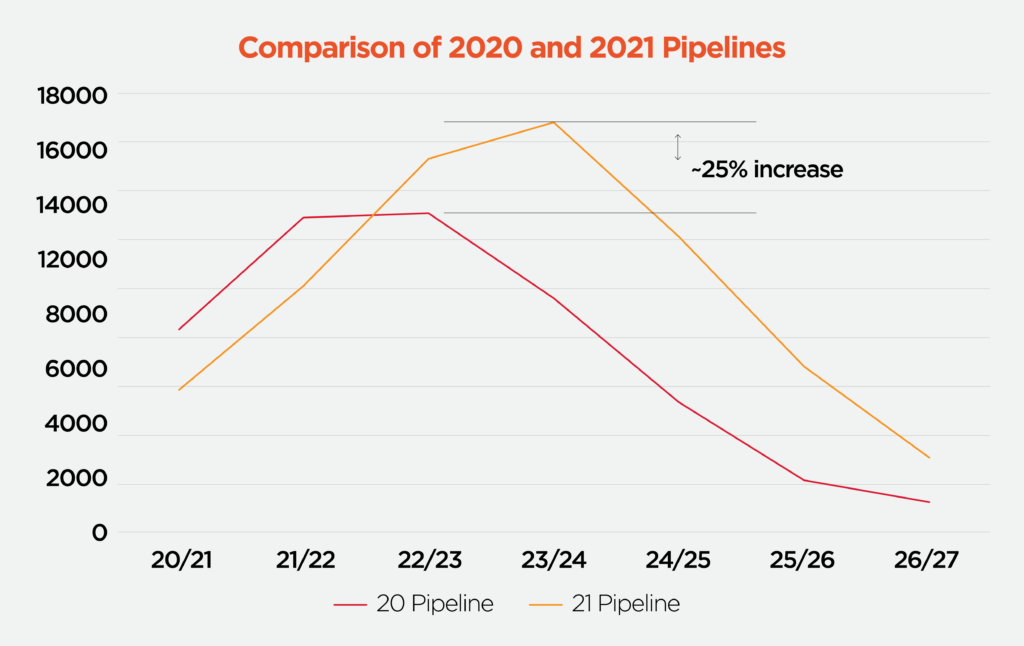

In the five years between 2020/21 and 2025/26, the major projects pipeline is valued at $61.9b. This compares with $50.7b identified in the 2020 QMPPR between 2019/20 to 2023/24.

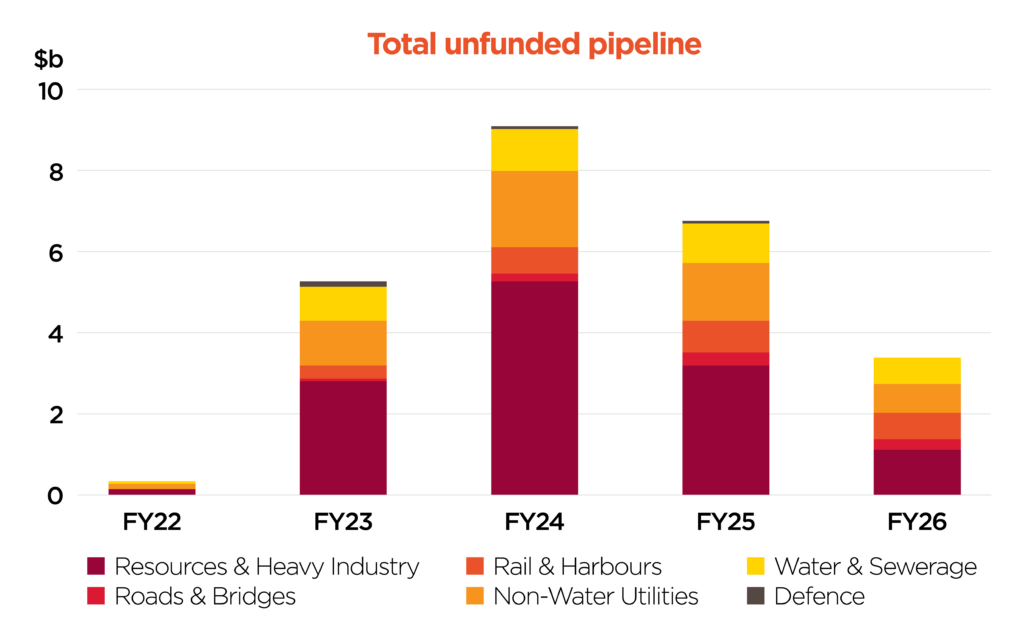

ABOVE: Total unfunded pipeline by sector with five-year forecast. Source: BIS Oxford Economics and QMCA member knowledge.

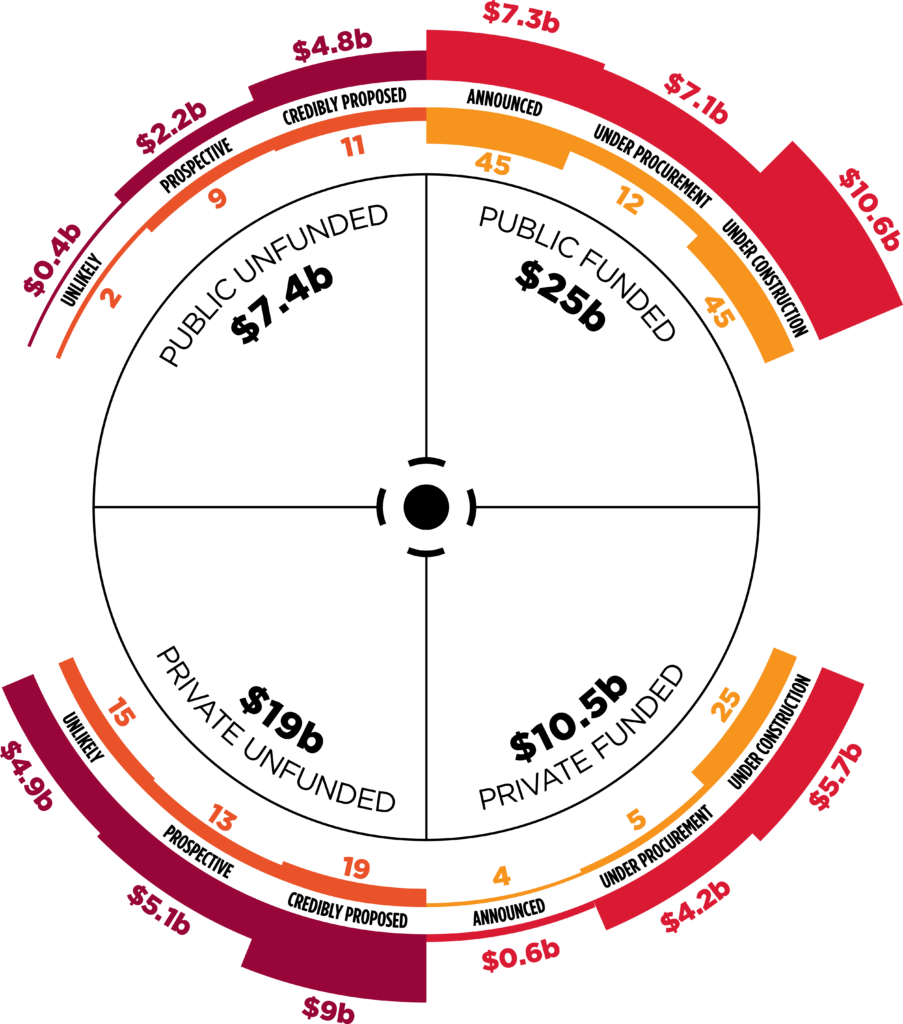

The public sector accounts for 52% of the total pipeline (compared to 50% in 2020) but 70% of funded work (compared to 73% in 2020). In this year’s pipeline there is a significant increase in privately funded electricity and mining and heavy industry projects which means the pipeline is slightly less reliant on publicly funded projects than in the past.

ABOVE: Funded pipeline by sector with five-year forecast. Source: BIS Oxford Economics and QMCA member knowledge.

- Pipeline activity is projected to surge over the next two years. Major project activity rises 41% in 2021/22, surpassing $10b for the first time since 2013/14. Critically, 97% of activity in 2021/22 is funded, meaning that a substantial increase in activity – barring capacity and capability constraints – is locked in. Total pipeline activity is expected to surge to over $15b in 2022/23, although one third of activity in that year remains unfunded.

- $35.5b (57%) of the pipeline value is funded compared to 55% in April 2020, while $26.4b (43%) is unfunded. Unfunded projects represent just 3% of activity in 2021/22, but this rises to over 50% from 2023/24.

- As reported in 2020, funded work is increasingly being concentrated in ‘mega projects’ over time. In 2019/20, 20% of major project work was in projects valued at $50m to $200m. In 2020/21 this had dropped to 13% – and this downward trend is projected to continue through the next five years. By contrast, over half of all pipeline activity is expected to be concentrated in projects worth over $1b in each of the next five years, up from 36% in 2018/19. This creates challenges for industry sustainability, risk management and the ability for companies to grow and develop through project execution.

- The graph below highlights the difference in the magnitude of the major project pipeline outlook from 2020 to 2021. The peak is approximately 25% higher and extended from previous years. The tail off in investment, however, is likely to be filled with infrastructure investment brought forward and required for the Olympics.

- There are very large differences in the major project outlook by region. Unsurprisingly, given the concentration of Qld’s population in SEQ, around 45% ($15.9b) of all funded work in the pipeline is focused there. Brisbane itself has the highest levels of work ($6.8b). Meanwhile, more of the riskier, unfunded projects lie in central, northern and western regions of the state, as these regions tend to have a greater share of investment in mining, large water projects and electricity generation projects that are more typically unfunded. The Ipswich–Toowoomba–Logan corridor has the strongest growth in funded work over the next three years, while the Townsville, Cairns, Fitzroy, Wide Bay and Outback regions all have very strong growth potential.

The Way Forward

The 2021 QMPPR shows a large cycle in major project activity playing out across the next five years. There are significant upside and downside risks from the ongoing impacts of COVID-19, and the tightening industry capacity and capability.

There is a need to rethink infrastructure targets given relatively strong population growth, hosting the 2032 Olympics, and meeting industry and environmental sustainability goals.

We recommend:

- Governments continue to seek consistent, collaborative, long-term value approaches to tendering and procurement. Collaborative Contracting models offer this

- Focus on medium-term development of the funded pipeline, particularly from 2023–2026.

- Accelerate infrastructure development in fast-growing regions of Queensland to support regional economic growth and development (water and energy projects).

- Finalise the SEQ City Deal in 2021. This is critically important to ensure investment is targeted in the right areas ahead of the Olympics.

- Governments to target regional deepening of the project pipeline.

- Queensland Government to transition to more stable, growing revenue streams for funding infrastructure, including debt and asset recycling measures and direct private investment either in partnership or alongside Government investments.

- Queensland Government to review policies that may be constraining growth in private infrastructure provision.

- Government and industry to develop an infrastructure plan to reduce carbon emissions in Queensland and identify opportunities for investment in the future low carbon economy, particularly through new industries such as hydrogen.

- National and State Governments to include resilience/adaptation work in infrastructure audits.

- Work with Infrastructure Australia to develop a comprehensive quantitative analysis to aid public decision-making.

Downloads

Click on the links below to download report information and datasets:

- DOWNLOAD THE REPORT EXECUTIVE SUMMARY

- DOWNLOAD THE FULL QUEENSLAND MAJOR PROJECTS PIPELINE REPORT

- DOWNLOAD THE REPORT DATA SETS

- DOWNLOAD THE PRESENTATION PACK

Download the region by region breakdowns

Our Partners

Thank you to our partners Bennett and Bennett, BMD and ARTC Inland Rail for their support of the 2021 Queensland Major Projects Pipeline Report.

BMD

BMD Constructions is a wholly owned subsidiary of the BMD Group, and provides civil and industrial construction services to public and private sector organisations throughout Australia. Established in 1979, BMD Constructions strives to be deliberately different in its approach to business with every project being regarded as an opportunity to build long term relationships of mutual benefit.

Bennett + Bennett

Bennett + Bennett has been providing advanced Surveying, Town Planning and Spatial solutions for over 50 years.

Established in 1968 on the Gold Coast, we have been privileged to play a significant role in key projects and areas of development legislation which have helped shape South East Queensland.

Our success and longevity within the industry comes from our experience, and ability to work with an outstanding array of clients who continue to put their trust in us. Through collaboration, ongoing improvement, upskilling and technology investment we are able to adapt our services to best meet their changing needs, whilst ensuring we remain current in an evolving market.

ARTC Inland Rail

Inland Rail is a fast freight backbone that is transforming how goods are moved around Australia, generating opportunities for our regions and our economy, now and well into the future.

Spanning more than 1,700km and comprising 13 individual projects, Inland Rail is the missing link in our national freight network, providing transit times of less than 24 hours for freight trains between Melbourne and Brisbane via regional Queensland, New South Wales and Victoria.

During construction it will create more than 21,500 jobs, including more than 11,800 in Queensland. Work on Inland Rail is well underway, with the Parkes to Narromine section in NSW commissioned in September 2020.

The Australian Government has committed funding for the Australian Rail Track Corporation (ARTC) to build Inland Rail, in partnership with the private sector.