It’s easy to overlook planning for your super and retirement when you’re focused on working hard and managing the demands of daily life.

However, by starting early and taking advantage of time, compound returns in super can be one of the most powerful tools for building a secure financial future.

What is compounding and how does it work with super?

Simply put, compounding happens when the money you earn on an investment is reinvested, so you gain returns on both your original amount and any returns you’ve already earned. Thanks to compounding, these returns will generate more returns year after year, helping your balance grow faster over time.

Compounding is particularly powerful for long-term investments like super, as it naturally takes advantage of the returns that have been building up over decades.

The power of compounding over time

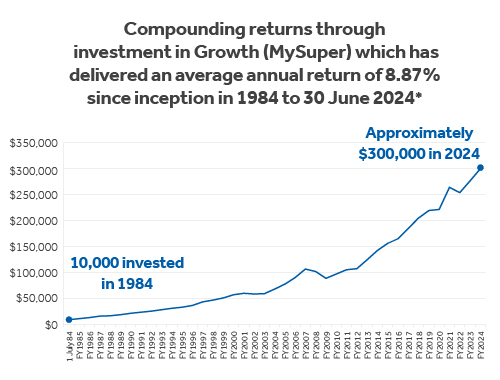

In 1984, if Alice had invested $10,000 in our Growth (MySuper) option and she didn’t make any more contributions…

As at 30 June this year, Alice’s investment would have grown to approximately $300,000*. The impact of compounding is significant over a long time and the best part is that Alice didn’t need to do anything – it happened automatically with super.

Ways to take advantage of compounding

- Remember that super is a long-term investment: Short-term market volatility is inevitable but staying focused on long-term returns and riding out market volatility as opposed to making frequent switches between investment options can help you capitalise on compounding returns.

- Choose an investment option that works for you: Generally, if you’re young, you have time to ride out any ups and downs in market performance, so now’s the time to maximise your super’s growth. Cbus Super offers a range of investment options to cater to a range of investment goals. Always consider your personal circumstances before making any decisions.

- Supercharge your balance with a personal contribution: Employment in building, construction and other allied industries isn’t always linear and income may fluctuate so consider maximising your savings during high earning periods to offset slower periods. Even a small contribution made early in your working life could grow significantly over time to boost your balance.

- Speak to the Cbus Super Advice team: Cbus Super members can access both general advice and if applicable, personal advice which might include choosing the right investment option, and which type of contribution to make. Contact the Cbus Super Advice team on 1300 361 784, 8.30am to 6.00pm, Mon to Fri AEST.

Compounding is most effective over time so spending some time to set your super up early in your working life is a simple yet powerful way to plan for your future. It can build a steady foundation for your retirement quietly in the background, giving you peace of mind today.

*The Growth (MySuper) option has delivered an average annual return of 8.87% since inception in 1984 to 30 June 2024. This example is for illustration purposes only. Balances have been calculated using financial year returns compounding annually. Investment performance is based on the crediting rate, which is the return minus investment fees, taxes, and until 31 January 2020, the percentage-based administration fee. Excludes fees and costs that are deducted directly from members’ accounts. Past performance is not a reliable indicator of future performance.

This information is about Cbus Super. It doesn’t account for your specific needs. Please consider your financial position, objectives and requirements before making financial decisions. Read the relevant Product Disclosure Statement (PDS) and Target Market Determination to decide if Cbus Super is right for you. Call 1300 361 784 or visit cbussuper.com.au.

United Super Pty Ltd ABN 46 006 261 623 AFSL 233792 as Trustee for the Construction and Building Unions Superannuation Fund ABN 75 493 363 262 (Cbus and/or Cbus Super)