Employment in Queensland’s infrastructure sector is set to boom and bust over next 18 months – according to research commissioned by the Queensland Major Contractors Association and the Infrastructure Association of Queensland Inc which outlines a major period of project uncertainty as the state’s infrastructure pipeline stalls.

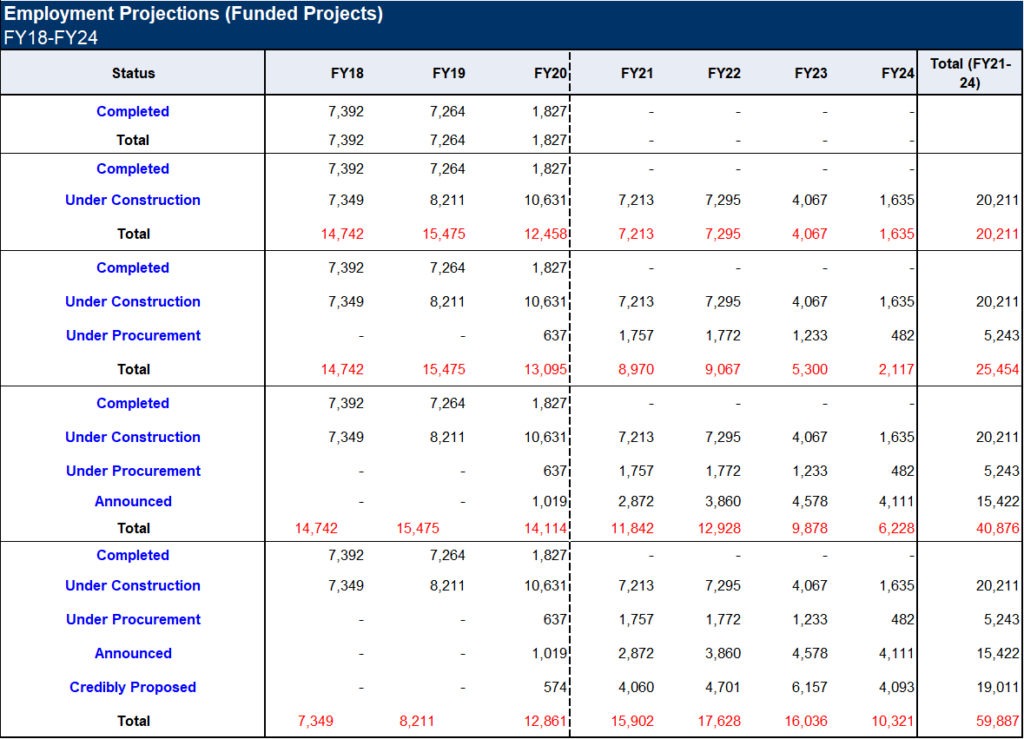

The BIS Oxford Economics research shows total employment for the coming year at 12,861, peaking at 17,628 in FY22 before dropping to 10,321 in FY24, a 20% drop against today’s numbers and a 42% drop against the peak period.

When correlated against the 2020 Queensland Major Projects Pipeline Report, the reason behind the looming unemployment crisis is a lack of funded projects beyond the on-going investment in existing and smaller projects throughout the state.

Released in March 2020, the report showed that over $23.2bn of projects in the 4-year pipeline are unfunded, with many unlikely to reach shovel ready status and also unable to employ workers currently engaged on projects due for completion within the next two years.

QMCA, CEO, Andrew Chapman, believes that it is critical to the state’s economic future that all tiers of government and the private sector work collectively to ensure that industry has a sustainable pipeline of future projects.

“At every level of government, infrastructure investment is touted as the central driver of economic growth and recovery post-COVID-19. However, the sector will see a significantly drastic decline in 2022.”

“We encourage further collaboration at all levels of government to address the gap between project announcement and funding so that projects can proceed and drive the state’s recovery.”

“This will only be achieved through a long-term infrastructure plan that focuses on economic infrastructure that provides clear returns to the wider economy. According to the ABS, the total multiplier for the construction industry is 2.99 – meaning that every dollar spent on construction boosts economic activity by nearly $3.[1]”, said Mr Chapman.

Due to the time involved in the development, design, funding and procurement of infrastructure projects it is crucial that there are streamlined processes for project planning and approvals.

“For projects to commence in 2022/23, it’s important that further economic infrastructure projects and programs are progressed to procurement. Beyond Cross River Rail and Inland Rail, there needs to be a pipeline of major projects that can sustain the state’s infrastructure sector, and provide long term economic value,” said Mr Chapman.

The research also acknowledges that the private sector has a role to play and more must be done to bring privately funded projects to fruition in Queensland.

“In 2019, the value of funded private sector work was $8.3bn, compared to $7.6bn in 2020. More worryingly, the value of privately funded work announced or under procurement has nearly halved from $3.5bn to just $1.8bn. Therefore, we must look at the conditions in place to enable private investment.”

IAQ CEO, Priscilla Radice welcomed the recent announcements at Federal and State level to focus on streamlining approval processes and reducing red tape.

Key to encouraging private sector investment will be ease of doing business while ensuring community expectations are met to ensure projects progress with both certainty and support,” said Ms Radice.

“We know historically for every $1 the government spends on productive infrastructure the private sector spends $13 – the relationship is symbiotic.”

“The public and private sectors working in partnership is vital to boost investment, build vital connecting infrastructure which strengthens industries, supports jobs and enables future growth.”

“Is it through a balanced pipeline of private and publicly funded projects that our industry can continue to employ thousands of workers and deliver projects that directly benefit communities and rebuild our economy,” said Ms Radice.

“A focus on regional Queensland and how infrastructure investment can transform, the state’s future industries is also crucial.

“Sustainability isn’t just about environmental matters; it’s much broader – our economic sustainability is linked to economic diversity as this provides resilience. Queensland is faced with immense challenges as we transition to a low carbon world, but those challenges also provide extraordinary opportunities. To realise the benefits, we need long term positive transition plans for regional communities and greater trust between the public and private sectors to invest together in innovative ways,” said Ms Radice.

“The

data shows that beyond 2021 the future for employment in Water and Energy

construction is bleak with only a handful of small projects accounting for

minimal employment. For regional Queensland, which has the potential to be a

driver of clean energy and water security, this is potentially a missed

opportunity.

[1] ABS 5209.055.001 table 5 for FY2018