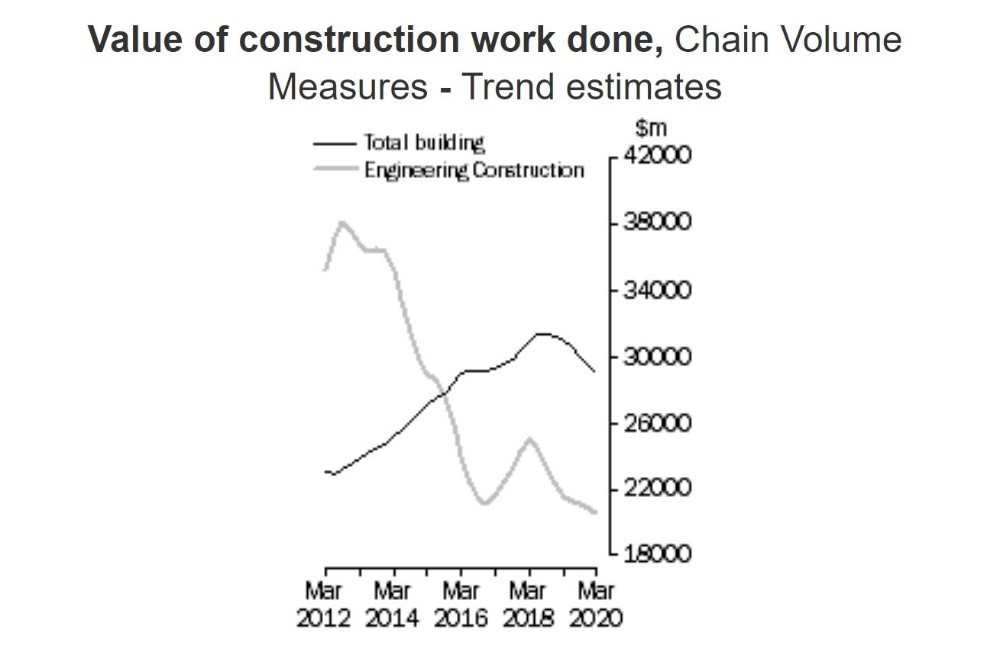

The March data from the Australia Bureau of Statistics shows that a predicted infrastructure downturn has become a reality with a 5% drop in engineering activity in Queensland during the year and a 4% drop nationally.

The decline in Queensland activity has long been forecast with The 2018 and 2019 Queensland Major Project Pipeline Reports identifying structural issues in Queensland’s future project planning and funding.

QMCA CEO Jon Davies outlined the current situation “In 2018 we forecast a decline in engineering activity in 2019/20 due to an identified lack of viable projects to replace those coming to an end. A year later, we predicted a sector-wide decrease in projects of around $1.4B in 2019/20 unless funding for new projects is secured.”

“The March ABS figures back up those predictions, and our sector is in an entirely avoidable downturn that is a result of poor planning, a failure to listen to industry’s needs and continual infighting between all sectors of government.”

“QMCA called for all parties to work together to ensure a smooth pipeline of projects that are not plagued by periods of boom and bust. We also asked for greater intragovernmental cooperation to set attractive market conditions to make Queensland appealing to private sector investment.”

Despite this, little action was taken, forecast became a reality, resources moved to the Southern States and businesses have struggled to maintain a market presence, employment and investment. At the same time projects became mired in controversy, with pork-barreling and politics at all levels of Government being prioritised over the need to deliver the infrastructure required by Queensland’s communities and businesses.

“Whether electorally serendipitous or otherwise, tendering activity started to pick up towards the end of last year. At the end of December, a glut of Government procured infrastructure projects hit the market, reaching a crescendo as COVID-19 hit, forcing bid teams to piece together multi-million-dollar tenders from hundreds of home offices across Queensland,” said Mr Davies.

While unfortunate in terms of timing and pressure on the sector, it allows the State and the Federal Government to expedite procurement of infrastructure projects to assist with post-COVID-19 economic recovery.

“Politically, we see unprecedented cooperation between the State and Federal governments regardless of party affiliation or perceived ideology. We would ask that this spirit of cooperation continues and is applied to the planning and funding of infrastructure not just in the short term but from this point forward.”

“Given the already high level of State debt before the pandemic and the subsequent economic stimulus borrowings, any COVID-19 recovery plan needs to consider the medium and long term as much as the short term so that the construction output does not fall off a cliff in 2-3 years.”

“Construction will act as the long-term driver of economic growth post-COVID-19, but only if we do not end up in a cycle of boom and bust. Critical to the success of restarting our nation’s economy will be the measured release of infrastructure projects to market via a transparent pipeline of work that is sustainable in terms of project funding and delivery.”

“QMCA supports this strategic approach, and our members stand ready to meet the challenge, but it will require unprecedented levels of cooperation and a significant financial investment.”

“In return, Queensland will receive much-needed infrastructure and industry will invest in employment, training and workforce development to meet demand. Infrastructure currently accounts for 10% of the working population and contributes 8% of GDP and is ready to grow on the back of a sustainable and transparent long term pipeline of planned and funded projects,” said Mr Davies.