2024 Queensland Major Projects Pipeline Report

Queensland Major Contractors Association Launches 2024 Major Projects Pipeline Report Highlighting A ‘Golden Decade’ For Infrastructure Investment

The Queensland Major Contractors Association (QMCA) has unveiled the 13th instalment of the Queensland Major Projects Pipeline Report (QMPPR), revealing a substantial increase in the pipeline’s value to $103.9 billion over the next five years, up from $92 billion in the previous year.

Andrew Chapman, CEO of the QMCA, highlighted the significance of the latest report.

“Queensland is on the verge of a golden decade of infrastructure investment and delivery. We are seeing unprecedented investment in critical sectors, including hospitals, housing, energy and electricity transition, transport infrastructure, defence, water projects such as dam safety upgrades, and the Brisbane 2032 Olympic and Paralympic Games infrastructure. There is immense opportunity ahead, but we must be prepared to tackle the challenges.”

Report Summary

2024 marks the 13th instalment of the Queensland Major Projects Pipeline Report (QMPPR) developed in conjunction with Oxford Economics Australia, Construction Skills Queensland (CSQ), Arcadis and Aurora Marketing. For over a decade, the QMPPR has delivered a comprehensive list of major engineering construction projects and an analysis of construction activity. The 2024 QMPPR covers projects expected to be in the construction phase over the next five years to 2028/29.

DOWNLOAD THE REPORT EXECUTIVE SUMMARY

DOWNLOAD THE FULL REPORT

DOWNLOAD BRISBANE SLIDE DECK

DOWNLOAD TOWNSVILLE SLIDE DECK

DOWNLOAD GLADSTONE SLIDE

DOWNLOAD TOOWOOMBA SLIDE DECK

The 2024 QMPPR presents a generally positive outlook for major project work in Queensland, but also acknowledges the constraints and risks by sector and region. While activity in 2024/25 was lower than predicted a year ago, relatively robust growth in major project work is predicted for 2025/26 and 2026/27 with transport-related activity joined by a strong phase of investment in water and energy-related projects. As in previous years, activity could surge higher if the large bank of currently unfunded projects were committed to.

Over the past 18 months, the Commonwealth Government’s review of infrastructure funding in 2023, and subsequent changes to funding arrangements, has caused a ripple effect of delays in projects progressing into procurement and delivery. This has had strong implications for the Queensland market, where the works delivered in 2024/25 were 11% less than predicted a year ago and the current financial year (2024/25) has an anticipated 13% reduction in the delivery of planned work. Planned projects have also been shifted sideways to accommodate increased costs on existing projects.

We are also facing a far more complex environment regarding project development, approvals and financial decisions, in addition to a very tight labour market. Changes made to taxation, environmental approvals and in particular the industrial relations environment, have had – and continue to have – a negative impact on project viability and investment confidence. It is important that these industry level concerns are addressed to ensure that investment decisions can be made in a timely manner with a proper understanding of the expectations on the project developers and the construction industry.

The scale and diversity of projects in the 2024 QMPPR highlight the number of public policy objectives requiring an infrastructure solution over the remainder of this decade – including better transport links, energy transition infrastructure, additional water supply, defence and facilities for the 2032 Brisbane Olympic and Paralympic Games. The private sector will play a key role in delivering (and in many cases funding) these important economic projects, as well as driving further investment in Queensland’s large resources and mining industry.

The 2024 QMPPR demonstrates that the next five years will be a busy time. In addition to the engineering projects in this report, Queensland will also be investing heavily in health and education infrastructure and, later this decade, a strong upswing in residential building activity is also expected. This activity combined with ongoing competition for skills and resources from other Australian states and territories, is expected to see sustained pressure on costs, industry capability (skills) and capacity.

In this environment, it will be critical that government and industry work closely together to ensure the major project pipeline is planned and procured effectively, efficiently and collaboratively; that required skills, and industrial capacity can be targeted early, industry policy and regulation allows projects to be delivered productively, and we return our focus to value for money.

Key Findings

- Delays have affected the projected work to be delivered through the first two years of the pipeline with the bulk of the project work – $71b of the $103.9b in the pipeline – expected to be delivered in 2025/26– 2027/28.

- The pipeline is getting bigger. The current five-year pipeline has increased to $103.9b, which is 13%, or $12b, higher than in the 2023 QMPPR. Importantly, 20% of this increase in pipeline from 2023 is due to announced cost increases on existing projects. The funded activity has grown by $8b to $62.4b (14% increase) although, $2.2b of this increase is attributed to revised project costs for existing projects.

- Unfunded activity is still large, presenting uncertainty and risks to the major projects industry if roadblocks to project delivery cannot be addressed. Overall, $41.6b of the pipeline (40%) is unfunded, up from $37.6b in 2023 (a 10% increase). The value of unfunded projects increases each year from 16% of the pipeline value in 2024/25 to 42–48% of the pipeline value over 2026/27 to 2028/29. The risk to pipeline activity stems from the high level of unfunded work scheduled from 2026/27 onwards. Overall, unfunded work averages $11b per annum over the three years to 2028/29. While not necessarily a public sector issue, as projects move to completion in 2024/25 it will be important to streamline approvals processes and provide certainty that allows project developers to make timely decisions.

- There is distinct variation in the outlook by region. While the overall outlook for Queensland has improved, six regions have lower levels of funded works as part of their pipeline activity compared to last year’s QMPPR – Cairns, Brisbane, Gold Coast, Townsville, Darling Downs–Maranoa and Outback. In contrast, the Wide Bay region is expected to be the fastest growing region in Queensland on the back of the $14b+ Borumba Pumped Hydro Project and Paradise Dam that are both due to commence in 2025/26.

- Activity outside of South East Queensland remains the most uncertain. Much of the unfunded work in this year’s pipeline continues to remain concentrated in regions outside of Brisbane, with Fitzroy and Mackay- Isaac together making up 55% of total unfunded work. Both regions have a high concentration of mining and heavy industry projects. Given the high amount of unfunded resource-related activity ascribed to them, it raises the pipeline risk in these regions. These projects are suffering some level of uncertainty due to changing investment regimes, lengthy approval processes and variability in global commodity markets.

- Demand-side pressure and rising costs require renewed focus on productivity. While construction cost escalation has slowed due to easing international conditions, construction costs remain elevated as the drivers of escalation shift towards domestic factors. A key measure of construction cost growth, the engineering construction implicit price deflator (IPD) is estimated to have grown by 4% in 2023/24. While this is slower than the record growth of 8.2% in 2022/23, it still represents an increase in costs, with accelerating prices for labour (construction wages) and construction materials offsetting weaker growth in prices for steel and oil products such as diesel and bitumen.

Rising levels of construction activity in Queensland from renewable electricity generation, water and sewerage works, residential and non-residential building and Brisbane 2032 Games-related construction will place further demand-side pressure on costs (potentially risking further project delays); unless there is a renewed focus on building supply- side capacity and improved productivity.

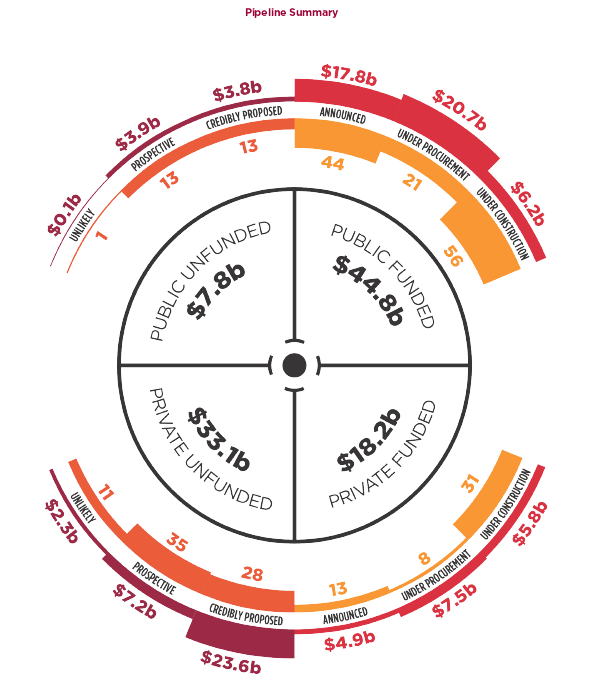

Pipeline Summary

Key Statistics

Key Statistics

- The major projects pipeline – including funded and unfunded projects – is now valued at $103.9b. This is much higher than the previous two QMPPRs ($92b in the 2023 QMPPR and $71.3b in the 2022 QMPPR).

- $62.4b of the pipeline value is funded, up from $54.4b in 2023 and $41.6b is unfunded, up from $37.6b in 2023. Although the funded pipeline activity has increased more than the unfunded works, the funding composition overall is unchanged from last year’s report, with funded projects still making up 60% of overall pipeline activity.

- 40% of the pipeline is unfunded which is in line with the 2023 QMPPR. Fitzroy and Mackay– Isaac–Whitsunday together make up 55% of total unfunded works. These regions are heavily dependent on resources and heavy industry projects.

- The public sector accounts for 72% of all funded work. The proportion of public sector projects across the total pipeline has remained in line with the 2023 QMPPR at 51%.

- Currently funded activity peaks in 2026/27 at $15.7b, before moving lower in 2027/28 and 2028/29. If all unfunded work proceeds ($11.5b), total major project activity would surge to $27.3b annually in 2026/27 and exceed the level of work done at the peak of the resources boom in 2012/13 ($19.1b).

- Unfunded activity averages $11b per annum over 2026/27– 2028/29 with the private sector responsible for around 80% of this. The mining and heavy industry sector makes up 50% of private unfunded work and the non-water utilities sector accounts for 46%.

- The dominance of ‘mega projects’ (valued at over $1b) has increased in funded works. Mega projects make up 58% of funded pipeline activity over the next three years, up from 51% in the 2023 QMPPR.

- Relative to last year, funded activity in the pipeline has fallen for six regions – Cairns (-26%), Brisbane (-14%), Darling Downs– Maranoa (-3%), Gold Coast (-2%), Townsville (-2%) and Outback (-1%).

- Wide Bay is the fastest growing region in the 2024 QMPPR. Total funded major project construction activity over the next five years, compared to the previous five years, will increase significantly. The ramp up in construction from the Borumba Pumped Hydro Project due to commence in 2025/26 is a major driver of this growth.

Risks to The Major Projects Pipeline

With Queensland’s construction sector set for higher levels of work over the next five years and national construction activity also on an upward trajectory, the competition for resources will present potential downside risks to Queensland’s major project pipeline.

Key downside risks include:

- Increase in resource demand across plant, labour, equipment, and machinery over the coming decade. For Queensland, this pressure is increased by a relatively (in comparison to other states) more robust building sector, numerous large projects to assist in the energy transition and key developments in preparation for the Brisbane 2032 Games.

- Demand for key construction resources could be further stretched as residential construction increases nationally over the latter half of the decade. Queensland is likely to experience increased competition for resources, particularly from New South Wales and Victoria whose residential investment is set to increase in the long term.

- Due to cost escalation, many major developments face an increased risk of postponement or cancellation. These cost pressures are increasingly driven by domestic pressures as international supply chain concerns begin to ease. This has been evident over the past 18 months where due to cost pressures on existing budgets, various projects and programs have been moved ‘out a few years’ to assist with balancing budgets in the short term. This has already occurred with the State Budget this year and, before that, with Brisbane City Council looking to save 10% of the originally committed spend to manage cost impacts on business and residents.

Industry Thoughts

Event Galleries

Thanks to the 1,000 guests who joined is in Brisbane, Townsville, Gladstone and Toowoomba, check out the best pics from the events here.

Our Supporters

The 2024 Queensland Major Projects Pipeline Report is proudly supported by:

Gold Partners – CSQ – Construction Skills Queensland, Acciona John Holland and Webuild.

Regional Partners Brisbane – Bennett + Bennett and Tactic

Regional Partners Toowoomba – Bennett + Bennett

Regional Partners Townsville – BMD Group, Sunwater and Wulguru Technical Services

Regional Partner – Queensland Hydro

Report Partners – Degnan

Event Partners – Toowoomba and Surat Basin Enterprise, AI Group, MITEZ, Regional Development Australia Townsville and North West Queensland and Gladstone Engineering Alliance

Construction Skills Queensland

Gold Sponsor and Key Contributor

As the peak body for training and workforce development, Construction Skills Queensland (CSQ) has a singular focus – nurturing an ongoing pipeline of skilled construction workers for Queensland.

The task is undertaken via a myriad of support programs designed to tackle the ongoing challenge of attracting, developing and retaining talented people in our sector.

Our research and analysis provides insights into the workforce requirements of major projects in each region, and supports targeted workforce plans that provide security and sustainability to project budgets and timeframes.

Because each region and major project is unique, CSQ champions local training solutions to develop a ready supply of skilled workers for every stage of these high-impact bodies of work.

Big projects offer big opportunities and we are working to raise awareness of careers in construction for a whole new cohort of young job seekers.

We continue partnering with industry and schools to promote dynamic careers in construction as we grow our Construction Pathways campaign; helping students and job seekers find their pathway into the industry.

Find out more at: https://www.csq.org.au/

Acciona

Gold Sponsor

ACCIONA is a global leader in sustainable infrastructure solutions.

We invest in, develop, and operate infrastructure assets that address the needs of society and make our planet more sustainable.

Our people are empowered to be innovative, to demonstrate technical excellence and to deliver sustainable infrastructure solutions so we can contribute to economic and social development. Across our business the decisions we make every day are in the pursuit of designing a better planet.

In Australia, ACCIONA has evolved from a rich history of local companies who have delivered complex, sustainable, and iconic projects across this country for over 100 years. With a business that spans the entire value chain, from design and construction through to operation and maintenance, we combine our deep Australian knowledge with global experience to deliver a broad portfolio of sustainable infrastructure solutions, now and into the future, that are enhancing the lives of all Australians.

Find out more at: www.acciona.com.au

Learn more about how Acciona’s key services: Download prospectus

John Holland

Gold Sponsor

At John Holland, our purpose is simple: we transform lives. And we do this with everything we do.

From humble beginnings 75 years ago, we are proud to be one of Australia’s leading building, infrastructure, rail and transport companies. We’re incredibly proud of our history in Australia – but it’s what we’re delivering for the future that drives our teams each and every day.

Our diverse experience and expertise enable us to create innovative and enduring solutions for our customers. The fact we can do this across multiple industry sectors means we’re up for any challenge.

We’re currently delivering many of Australia’s largest infrastructure projects – from the Melbourne Metro Tunnel and Sydney Metro to the Australian-first Kidston Pumped Storage Hydro Project in Queensland – as well as significant water, property and urban renewal projects. You’ll even see us operating buses, trains and trams.

Our people-first philosophy puts us at the front of the industry and continues to attract the best and brightest talent.

Our customers trust us to deliver complex, city-shaping projects because we push boundaries and employ innovation in everything we do.

We transform lives.

Webuild

Gold Sponsor

Webuild is a global leader in the design and

construction of large, complex projects in the

sectors of sustainable mobility, hydropower, water

and wastewater management, and green buildings.

With almost 120 years of engineering experience deployed on five

continents, drawing on the skills of 87,000 people of more than 110

nationalities, Webuild builds complex, long-lasting infrastructure, assisting

clients in working towards achieving the Sustainable Development Goals

(SDGs) established by the United Nations.

Today, Webuild has a supply chain of more than 19,400 businesses and

operates in approximately 50 countries, concentrating activities in Italy,

Europe, North America, and Australia.

Webuild fosters an inclusive workplace and embraces diversity as a

competitive advantage that enables growth in every country where it

operates. It recognises its people as its most precious resource, with a

focus on health and safety. Environmental protection is a top priority for

the Group, which applies innovative solutions to ensure the sustainability

of its projects from construction through to long-term operations.

Find out more at: https://www.webuild-group.com.au/en/

Learn more about how Webuild’s key services: Download prospectus

Bennett + Bennett

Regional Supporter - Brisbane and Toowoomba

Bennett + Bennett is dedicated to being the leading providers of surveying, urban design, town planning, spatial and specialist major projects. Our experienced professionals take pride in delivering solutions that set industry benchmarks and our broad range of expertise in major projects allows for our involvement in the full project lifecycle; from initial design phases to project construction and delivery, ongoing asset management and compliance of final as-constructed, through to digital engineering and authority standards. Our range of services include drainage/inground services, bridge structures, earthworks, EOM flights, machine guidance, as-built management, structure/building methodology, 3D modelling, and survey management.

Key projects currently in development include MacIntyre Wind Farm (NSW), Snowy Hydro 2.0 (NSW), and Gold Coast Light Rail, Stage 3 (QLD).

Find out more at: https://bennettandbennett.com.au/

Learn more about Bennett + Bennett’s key services: Download prospectus

Tactic

Regional Supporter - Brisbane

We offer an efficient, fully-integrated office solution that allows us to deliver faster and better results for our customers. From leasing the right space to building award-winning designs, our collaborative team brings expertise, strategy and connections to guide the best outcomes for you.

We deliver workspaces that stimulate engagement and productivity using an integrated process that saves our customers time, money and stress.

It has been our pleasure to have assisted some of the biggest names in the industry. We are humbled by their support and pride ourselves on having helped facilitate the next phase of their business growth. The breadth and calibre of our clientele is testimony to our standing and reputation in the industry. We have worked tirelessly to understand client requirements, investigate opportunities and curate optimised space solutions – and we are happy to welcome you into the fold.

Find out more at: https://tactic.au/

Learn more about Tactic’s key services: Download Prospectus

Sunwater

Regional Supporter - Townsville

Sunwater is a Queensland Government-owned corporation that supplies about 40 per cent of the water used commercially in the state. This equates to more than 1300 gigalitres (GL) a year for irrigation, industrial and urban usage.

We own, operate and build bulk water infrastructure and undertake a variety of complex and often interdependent projects. These range from the design and construction of new and improved water infrastructure to the digital transformation of the way we work to ensure operational efficiency.

Our purpose is to deliver water for prosperity for the communities of regional Queensland we serve, and we understand our assets are important part of many communities and their overall economic wellbeing.

Find out more at: https://www.sunwater.com.au/

Learn more about how Sunwater’s key services: Download prospectus

BMD

Regional Supporter - Townsville

BMD Constructions is a wholly owned subsidiary of the BMD Group, and provides civil and industrial construction services to public and private sector organisations throughout Australia. Established in 1979, BMD Constructions strives to be deliberately different in its approach to business with every project being regarded as an opportunity to build long term relationships of mutual benefit.

Queensland Hydro

Regional Supporter

Queensland Hydro was established by the Queensland Government to design, deliver, operate and maintain long duration pumped hydro energy storage assets that will be the cornerstone for the transformation of the state’s energy system.

It is progressing two pumped hydro energy storage systems – the 2,000MW Borumba Project west of the Sunshine Coast and the 5,000MW Pioneer-Burdekin Project west of Mackay.

Wulguru Technical Services

Regional Supporter

Wulguru Technical Services was founded in 2020 in Townsville. With offices in Brisbane and Townsville we service all of North and SE Queensland and we deliver excellence in environmental practices across a range of sectors including; mining and minerals; defence; construction; agriculture; manufacturing; water and energy. Our future vision is: To become a sought-after provider of off-set advice, adaptive management plans, and compliance monitoring for State and Commonwealth offset projects.

Learn more at: https://www.wulgurutechservices.com.au

Learn more about how Wulguru Technical Services’ key services: Download a Prospectus

Degnan

Report Supporter

Degnan is a leading Australian-owned construction company, focused on delivering results through client collaboration, innovation, and teamwork. For more than 40 years, we’ve successfully delivered specialised solutions for challenging projects, adapting to evolving requirements and regulations.

Committed to driving innovation and excellence, Degnan is actively contributing to Queensland’s infrastructure development, delivering sustainable and innovative solutions on several key projects that meet the region’s needs. Our core values of quality, integrity, innovation, and teamwork guide everything we do.

Toowoomba and Surat Basin Enterprise (TSBE)

Event Partner - Toowoomba

Toowoomba and Surat Basin Enterprise (TSBE) is the go-to organisation linking business with opportunity to create sustainable growth and diversity for the region.

TSBE is an independent, member-driven economic development organisation actively linking our business community to opportunities across the Toowoomba, Western Downs, Maranoa and surrounding areas.

We’re committed to ensuring that our local business community will innovate, adapt and prosper and we take pride in encouraging major investment and promoting the vital need for new and upgraded infrastructure in our region.

AI Group

Event Partner - Townsville

The Australian Industry Group (Ai Group®) is a peak national employer organisation representing traditional, innovative and emerging industry sectors. We have been acting on behalf of businesses across Australia for 150 years.

Ai Group and partner organisations represent the interests of more than 60,000 businesses employing more than 1 million staff. Our membership includes businesses of all sizes, from large international companies operating in Australia and iconic Australian brands to family-run SMEs. Our members operate across a wide cross-section of the Australian economy and are linked to the broader economy through national and international supply chains.

Our purpose is to create a better Australia by empowering industry success. We offer our membership strong advocacy and an effective voice at all levels of government underpinned by our respected position of policy leadership and political non-partisanship.

MITEZ

Event Partner - Townsville

The Mount Isa to Townsville Economic Development Zone (MITEZ) is a regional organisation representing seven local government areas across the northern parts of Queensland. MITEZ encompasses Mount Isa, Cloncurry, McKinlay, Richmond, Flinders, Charters Towers and Townsville, a total land area of 271,732 square kilometres.

Strategically located, MITEZ forms a vital corridor connecting the extensive mineral and agricultural resources of the region to the rest of Queensland, Australia, and to international markets through road, rail, air and sea transport. Queensland’s resource-rich outback has undergone significant diversification in recent years, with new markets and industries fuelling growth among all MITEZ members. Our organisation is committed to maintaining its existing investments and to investigating new opportunities as they arise, helping to accelerate growth in the region and securing its economic future for decades to come.

RDA Townsville & North West Queensland

Event Partner - Townsville

Regional Development Australia is an Australian Government initiative that encourages all levels of government to collaborate to enhance the growth and development of Australia’s regions. The RDA is a national network of 50 committees across Australia’s capital cities and regions, including the Indian Ocean Territories, Norfolk Island and Jervis Bay Territory.

Regional Development Australia Townsville and North West Queensland (RDA) operates as a not-for-profit incorporated association across north and north west Queensland.

Our Committee members have diverse skills and broad experience, as well as demonstrated networks within our region. They understand local challenges, opportunities and priorities and are dedicated to strengthening the communities within the region.

Gladstone Engineering Alliance

Event Partner - Gladstone

Gladstone Engineering Alliance is the reputable self-funded not for profit organisation linking business with opportunity to create sustainable growth and diversity for the Gladstone Region.

We have a significant proven track record in running diversified private and public grants and projects with excellence. Our diverse capabilities stem from many years of project management assisting organisations of all sizes from the SME’s and global corporations. We have a history of successfully utilising government funding to deliver programs that provide lasting benefits and skills to their participants, businesses and the wider-community.

GEA is a well-established organisation that has been operating since 2003 and has a commitment to assist the Engineering, Manufacturing and Supply Chain Services of the Gladstone Region to meet world best practice for skills, proficiency, capability, and quality of work.