The QMCA’s Queensland Major Projects Pipeline Report (QMPPR) is the seminal document outlining the

major engineering construction projects in Queensland over the next decade with a specific focus on the

next five years. It has been developed in conjunction with Queensland Economic Advocacy Services (QEAS), Construction Skills Queensland (CSQ), Arcadis and Aurora Marketing.

Download The Slide Decks

Download the QMCA Brisbane Slide Pack

Download the CSQ Brisbane Slide Deck

Download The QMCA Toowoomba Slide Deck

Download The CSQ Toowoomba Slide Deck

Download The QMCA Townsville Slide Deck

Download The CSQ Townsville Slide Deck

Download The QMCA Gladstone Slide Deck

Download The CSQ Gladstone Slide Deck

Overview and Key Findings

This 14th instalment of the QMPPR highlights the significant amount of work in front of the industry over

the next five years to 2029/30. This year’s pipeline presents a positive outlook for major project work in

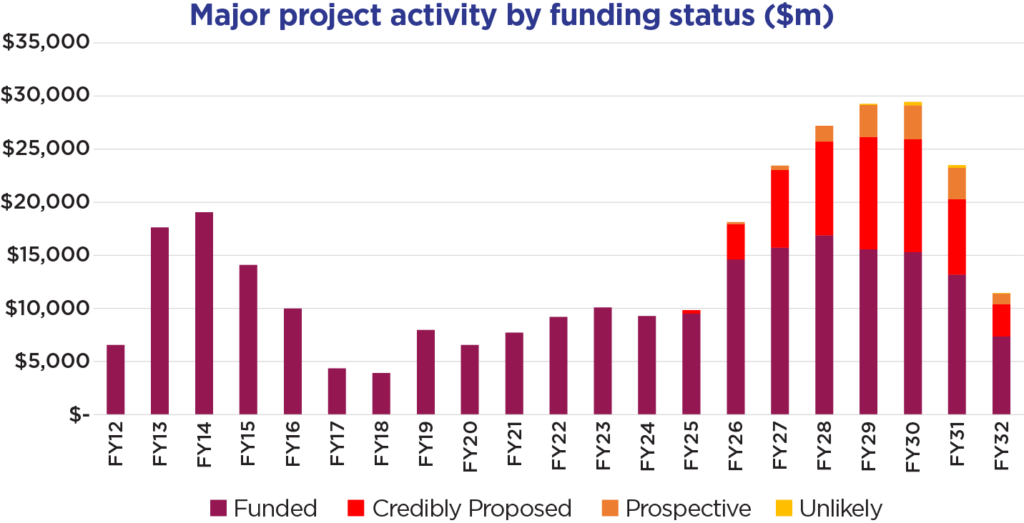

Queensland. There is a 15% to 21% increase (when including the 2032 Games infrastructure) in the pipeline over the 2024 QMPPR. The buoyancy of the state’s pipeline, if fully realised, appears to be more prolonged than the short sharp peak that occurred during the resources boom in 2011–2016. However, the industry faces significant constraints and risks in delivering this pipeline across sectors and regions, particularly regarding productivity, costs, skills, and funding, as well as the ability to bring projects to market in a timely manner.

Between 2011 and 2016, Queensland’s engineering construction industry delivered over $70b of works

($112b in 2025 prices), compared to the $127b required over the next 5 years. The next five years will require the industry to deliver a minimum of $14.5–$15b per year. This will require a substantive lift in delivery over a sustained period. While there has been a 60% lift in annual work delivered over the past five years, the industry will need to lift by at least another 60% to deliver funded works alone, and by more than 150% to deliver the peak output as reflected in the total pipeline.

Cost pressures across the industry remain a challenge, from labour through to materials and supply chain.

Forecasts indicate that construction costs will rise by over 7% in 2025, with annual increases above 6%

through to 2028. This continued pressure will impact budgets and project viabilities. These cost pressures are a particular concern in the resources sector, where capital is globally mobile. If not managed, they could constrain Queensland’s ambition to become a global powerhouse in critical minerals and

limit the state’s long-term economic growth.

Publicly funded works also face increased project cost uncertainty due to increasing costs, which may lead to further delays or cancellations. Addressing productivity is therefore critical to managing cost increases effectively and preventing them from being further exacerbated during delivery. The construction industry has long experienced boom-and-bust cycles, and the forthcoming period will be no different. The industry has perennially been short of employment to deliver the planned works. Infrastructure Australia has projected a shortfall of 54,000 workers across Queensland’s building and construction industry by 2026/27.

Across the major engineering and construction works in the pipeline, the workforce needs to increase from 26,000 construction workers to a peak of nearly 41,000 in 2029/30.

Activity in 2024/25 was lower than forecast. This was due, in part, to the ongoing impact of the Commonwealth’s 2023 review of infrastructure investment priorities and the new Queensland Government’s refocussing of priorities. It was also impacted by persistent challenges to project commencements, including higher construction costs, longer approval, development and procurement timeframes, and weak productivity.

While last year’s forecasts overstated activity in 2024/25, there is more certainty in the outlook for 2025/26 and 2026/27, with time-critical projects moving into delivery, subject to procurement. The inclusion of the 2032 Games infrastructure in the QMPPR for the first time reinforces this outlook, as this event contributes to a substantial portion of the pipeline both directly and indirectly.The scale and diversity of projects in the 2025 QMPPR highlights the number of public policy objectives requiring an infrastructure solution over the remainder of this decade – including improved transport links, energy transition infrastructure, and expanded water supply, defence infrastructure, and facilities for the 2032 Games.

The private sector will play a key role in both delivering and funding these important economic projects, as well as driving further investment in Queensland’s substantial resources and mining industry. The new Queensland Government has signalled its strong intent to attract private investment to help fund the state’s infrastructure needs. In a constrained financial environment, this will be critical in the years ahead.

In addition to the engineering projects in this report, Queensland is investing heavily in health (including the $18.5b Hospital Rescue Plan), as well as public and private housing. This activity, combined with strong competition for skills and resources from other states, particularly Victoria and NSW, will continue to pressure costs and industry capacity. In this environment, close collaboration between government and industry will be critical to ensure:

- Efficient planning and procurement of the major project pipeline

- Early targeting of the required skills and industrial capacity

- Productive project delivery supported by industry policy and regulation (industry industrial relations settings)

- Delivery of value-for-money outcomes by the industry.

Key Findings

The pipeline is surging

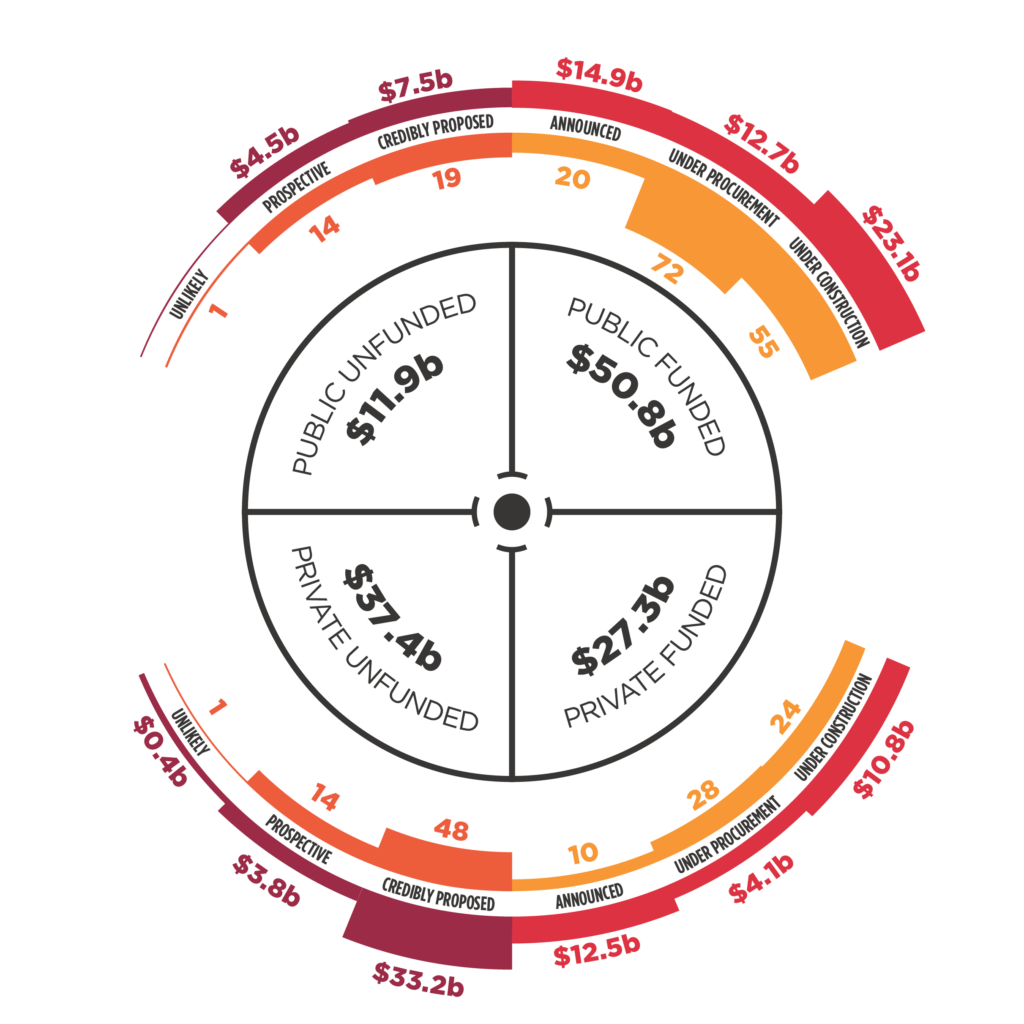

The current five-year pipeline has leapt to $127.5b ($120b excluding the Games infrastructure), up $23.6b or 22.7% on the 2024 QMPPR value of $103.9b (15% without the Games). The funded activity alone has grown by $13.9b to $78.1b (a 21.7% increase).

Large unfunded activity presents ongoing challenges

The size of the unfunded pipeline has grown to $49.4b (38.7% of the total pipeline), up from $41.6b in 2024 (a 7.8% increase). While unfunded activity as a share of the pipeline has declined slightly from 40% in 2024, its growing absolute value presents ongoing uncertainty and risks to the industry if delivery roadblocks are not addressed.

Unfunded activity is concentrated in later years

The proportion of unfunded projects is projected to rise from 19.3% of total pipeline value in 2025/26 to between 32.9% and 48% from 2026/27 to 2029/30. The risks of a high proportion of projects that are unfunded lie in the latter years of the pipeline. As projects reach completion, streamlining approvals and providing regulatory certainty will be critical to enable new projects to start more quickly and maintain momentum in the pipeline

The outlook varies greatly from region to region

There is distinct variation in the outlook by region. Fitzroy (up $2.9b), Brisbane (up $4.5b) and Sunshine Coast (up $3.7b) all had a significant lift in the value of their major project pipeline from the 2024 QMPPR with much of it resulting from the inclusion of the 2032 Games spend. Conversely, Wide Bay (down $3.1b), Townsville (down $0.8b) and Gold Coast (down $0.9b) all had declines in the value of their major project pipeline from the 2024 QMPPR.

Activity outside of South East Queensland remains the most uncertain

Much of the unfunded work in this year’s pipeline is concentrated in regions outside of Brisbane, with Townsville (60.3%), Mackay–Isaac–Whitsunday (55.7%) and Fitzroy (55.9%) all having a significantly high percentage of their respective major project pipelines currently unfunded. These regions (excluding Townsville) have a high concentration of mining and heavy industry projects.

Given the high amount of unfunded resource-related activity, it raises the pipeline risk in these regions. These projects face significant uncertainty due to changing investment regimes, lengthy approvals, commodity markets, as well as local regulatory settings impacting investor confidence.

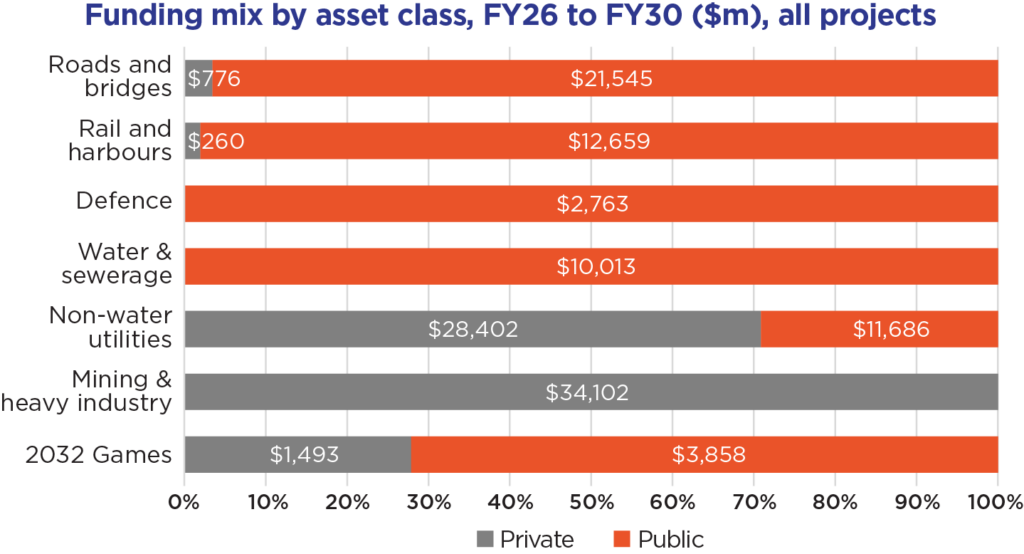

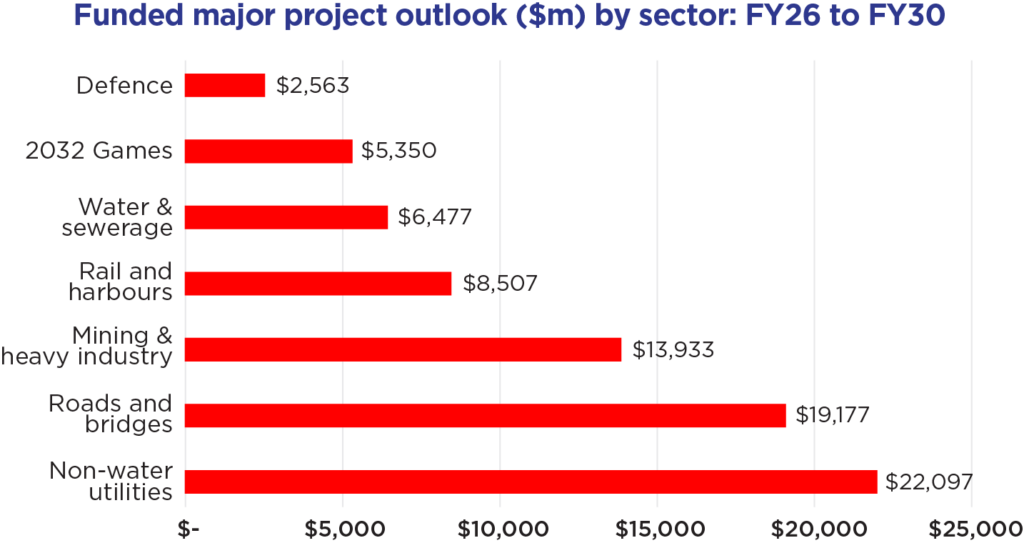

Changes by sector in the major project pipeline

Roads and Bridges had the biggest increase in funded major projects, up $6b in the 2025 QMPPR courtesy of new investments, including the $9b Bruce Highway Upgrade safety program. This is followed by Mining and Heavy Industry (up $3.8b). Only the non-water utilities (e.g. electricity) experienced a decrease in funded major projects. In terms of certainty, Defence (~93% funded) and Roads and Bridges (~86% funded) have the most secure pipelines. By contrast, Mining and Heavy Industry (59.6% unfunded), non-water utilities (43.2% unfunded), and Water and Sewerage (35.3% unfunded) face the highest levels of uncertainty.

Key Statistics

The major projects pipeline (funded and unfunded projects) is now valued at $127.5b ($120b excluding the Games infrastructure). This is up from $103.9b in 2024 and $92b in 2023.

$78.1b of the pipeline is funded, up from $62.4b in 2024 and $54.4b in 2023. The unfunded pipeline has grown to $49.4b, up from $41.6b in 2024 and $37.6b in 2023.

The funding composition has improved from last year’s report. Funded projects in 2025 now make up 61.3% of overall pipeline activity (up from 60% in 2024) and the public sector accounts for 65% of all funded work (down from 72% in 2023).

Funded activity peaks in 2027/28 at $16.9b, before moving lower in 2028/29 and 2029/30. However, if all unfunded work proceeds ($10.3b), the total major project activity would surge to $27.2b annually in 2027/28 and then $29.4b in 2029/30, exceeding work levels at the peak of the resources boom in 2012/13 ($19.1b).

38.7% of the pipeline is unfunded, down from 40% in 2024 QMPPR. Fitzroy and Mackay–Isaac–Whitsunday together make up 51% of the $25.2b total unfunded works. These regions are heavily dependent on resources and heavy industry projects with several large projects significantly contributing to this.

Unfunded activity averages $9.8b per annum over 2025/26–2029/30. The private sector is responsible for around 75% of this. The Mining and Heavy Industry sector makes up 41.5% of private unfunded work and the non-water utilities sector accounts for 35.4%. Both the number and total value of projects continue to trend from smaller to larger projects. The 2025 QMPPR has continued to see a shift from projects with an engineering value between $50–$250m, to more projects with an engineering value of over $250m.

Funded activity has risen for most regions. The fastest growing regions in the 2025 QMPPR are Fitzroy (up $6.5b), Brisbane (up $4.5b) and Sunshine Coast (up $6.5b). The exceptions to this regional upswing are Wide Bay (down $3.5b), Townsville (down $1.6b) and Gold Coast (down $0.9b).

Roads and Bridges had the biggest increase in funded major projects, up $6b courtesy of the new $9b investment into the Bruce Highway. This was followed by Mining and Heavy Industry up $3.8b. Only the non- water utilities (e.g. electricity) experienced a decrease in funded major projects as a result of projects being delayed or cancelled.

Risks to the Major Projects Pipeline

The competition for resources presents a significant risk to the major project pipeline, with strong construction activity across residential, non-residential building as well as engineering construction in Queensland, compounded by the upward trajectory of construction activity in other states. Key risks include:

Increasing resource demand

Over the coming decade, there will be higher resource demand across plant, labour, equipment, and machinery. The pressures are expected to be greater in Queensland than other states, given the scale of its building activity, energy transition projects, and preparations for the 2032 Games.

As of May 2025, the entire labour pool across all of building and construction in Queensland was 284,600 people. The engineering construction sector currently accounts for 29,400 people. In 2024/25 there were around 15,500 people employed in the major engineering construction projects across the state. The average construction labour demand for the projects in the QMPPR is estimated to rise from around 26,000 construction workers in FY26 to a peak of nearly 41,000 in FY30. This is a substantial lift in labour capacity, and one that the industry has struggled to resource in the past.

Material supply in the form of aggregates, concrete, and steel (fabricated and reinforcement) will come under pressure. Queensland produced and consumed some 1.2Mt of steel (structural and reinforcing) in FY24 and estimates indicate that a further increase in annual demand of over 200,000t is projected through to 2032. Equal strain is being placed on aggregate supply and production from quarries into civil works and concrete. Recent analysis by Cement Concrete and Aggregates Australia highlights that demand in South East Queensland alone will exceed 31.5Mt/yr off a current production of 24.5Mt and an approved licensed capacity of 30Mt (practical capacity being around 85% of this). These issues will become more acute if not addressed soon.

Increasing pressure from residential construction

Rising residential construction nationally over the latter half of the decade will further stretch demand for key construction resources. This will test the capacity of supply chains to provide materials critical to delivering the major projects pipeline, including steel, aggregates and concrete as well as building materials that will also be required for the Games and Hospital programs.

Inefficient procurement

The greatest risk to delivering the infrastructure pipeline is the slow and inefficient pace of procurement. Project approvals, particularly environmental approvals, have slowed down project development and procurement activities significantly. To meet the requirement to deliver an average of $14.5–$15.5b per year over the next five years, the industry must not only increase output but move projects through procurement far more efficiently.

Over the past two years, procurement has stalled due to a range of factors including the Federal Government’s 2023 Infrastructure Investment Review, the 2024 State Election, and the subsequent review of investment by the new Queensland Government ahead of the June 2025 Budget. Urgent action is needed to streamline procurement and accelerate project progression. Without this, delivery pressures will intensify, particularly against fixed deadlines, pushing required output beyond what can realistically be achieved.

Rising costs and declining productivity

With projected cost escalation of 6–8% over the medium term, combined with persistent industry productivity issues, many major developments face affordability challenges. This increases the likelihood of projects being postponed or cancelled over the longer term. The recent work by the Queensland Productivity Commission into the state’s Building and Construction Industry highlighted a 9% drop in productivity since 2018. QMCA’s analysis has reinforced this finding and highlighted that this is now affecting the industry’s ability to deliver the projected pipeline of work and achieve value for money. QMCA analysis indicates that if nothing else changes, delivering all the works in the QMPPR will require output of $1.66m per person/year, compared to recent years where around $700k–$1m per person/year has been achieved. To give clients confidence in pipeline deliverability, industry output and productivity must lift. Achieving this will require adjustments to policy and industrial relations settings, as well as improvements in site management, technical practices, and other operational requirements to drive both short- and long-term productivity gains.

About the Queensland Major Projects Pipeline Report

The Queensland Major Projects Pipeline Report is produced annually by the Queensland Major Contractors Association in partnership with members and leading industry and sector specialists. It provides a detailed outlook on the state’s major engineering and construction projects over the next decade and is a key reference for industry, government, and investors.

The 2025 Queensland Major Projects Pipeline Report is proudly supported by:

Gold Partners – Acciona, AutogenAI, Concentis, CSQ – Construction Skills Queensland, Fulton Hogan, Hughes et al

Silver Partners – Aptella

Regional Partners Brisbane – Bennett + Bennett, Perfect Contracting

Regional Partners Toowoomba – APA, Bennett + Bennett, Actemium Australia,

Regional Partners Townsville – BMD

Regional Partners Gladstone – BlueScope

Report Partners – CQG Consulting, Degnan, Hawthorne Civil, Joe Wagner Group, MMD Advisory, Stratagility, Windlab VSL

Event Partners – Toowoomba and Surat Basin Enterprise, AI Group, MITEZ, Regional Development Australia Townsville and North West Queensland and Gladstone Engineering Alliance